Understanding the Greek Parameters in Cryptocurrency Options Trading

What are the Greeks in options trading?

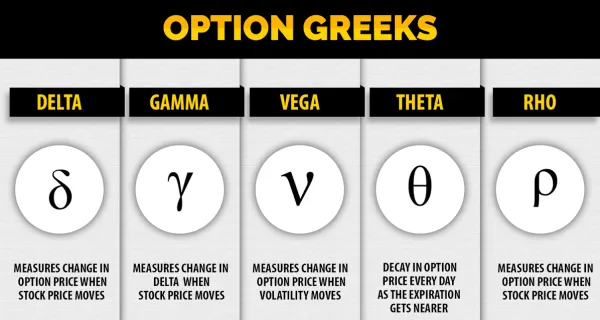

The Greeks are a set of statistical values that provide a way to measure the sensitivities of an option’s price to various factors such as the underlying asset price, volatility, time until the option's expiration, and interest rates.

What is Delta in crypto option trading?

In the context of options trading, Delta is a measure of how the price of an option is expected to change relative to the change in the price of the underlying cryptocurrency.

What does the Greek Theta represent in crypto options?

Theta represents the rate at which the option’s price is expected to decrease for each day that passes, holding all other factors constant. This measures an option's time decay.

What is Vega in cryptocurrency options trading?

Vega measures the option's price sensitivity to changes in the volatility of the underlying asset. It represents the amount an option's price will change for every 1% change in the underlying asset’s implied volatility.

How does Gamma affect my crypto options position?

Gamma measures the rate of change for an option's delta in response to a change in the price of the underlying asset. This helps option traders to adjust hedging activities.