Posts on the Topic Risk

Bitcoin Options ETFs offer flexible, nuanced diversification and income strategies by combining crypto exposure with options tactics like covered calls and spreads. These products enable tailored risk management, consistent income generation, and enhanced portfolio control without the complexities of direct...

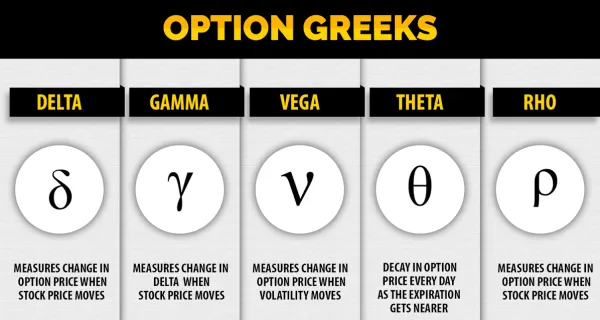

Crypto options trading offers flexibility and strategic opportunities by allowing traders to speculate on cryptocurrency price movements, hedge against market volatility, and potentially maximize gains through tools like inverse options; however, it requires navigating complex mathematical concepts and analyzing real-time...

Bitcoin options trading allows investors to speculate on Bitcoin's price movements without owning the cryptocurrency, offering flexibility and strategic opportunities through various option types like European and American. While it provides leverage potential and risk management benefits, it also involves...

Understanding the end time in option trading is crucial for determining when to exercise or let an option expire, impacting profitability and risk management. Effective timing strategies involve setting profit targets, using stop-loss orders, monitoring technical indicators, considering time decay,...

This article simplifies the basics of crypto options trading, explaining key concepts like call and put options, strike prices, and expiration dates. It highlights the advantages such as leverage, risk management, flexibility, cost-effectiveness, and profitability in various market conditions while...

Crypto options trading bots automate strategies to capitalize on market opportunities without constant monitoring, offering benefits like consistency, speed, data analysis, risk management, and 24/7 operation. Key features to look for include customizability, backtesting capabilities, robust security measures, an intuitive...

Ethereum Options Expiry is a critical concept in cryptocurrency trading, referring to the date and time when Ethereum options contracts expire, impacting market volatility, price discovery, risk management, and liquidity. Understanding these expiries helps traders anticipate market movements and adjust...