Posts on the Topic Volatility

Bybit’s crypto options platform offers a user-friendly, feature-rich environment for both beginners and pros to trade European-style contracts with robust liquidity. Setting up an account is straightforward, and the intuitive interface makes navigating option chains, placing trades, and managing risk...

Bitcoin Options ETFs offer flexible, nuanced diversification and income strategies by combining crypto exposure with options tactics like covered calls and spreads. These products enable tailored risk management, consistent income generation, and enhanced portfolio control without the complexities of direct...

Aggregated EtherOptions streamline Ethereum options trading by bundling contracts to enhance efficiency, while MCAE Initdelaytime optimizes execution timing based on market conditions, reducing risks and improving reliability in decentralized finance. Together, these innovations simplify complex strategies, lower costs, improve liquidity,...

Bitcoin futures and options are advanced financial tools enabling traders to hedge risks, speculate on price movements, and diversify portfolios in the volatile cryptocurrency market. With features like leverage, flexibility, and integration into regulated exchanges, these derivatives offer strategic opportunities...

Bitcoin options paper trading is a risk-free, simulated environment for practicing and refining strategies in realistic market conditions, benefiting both beginners and experienced traders. It helps users master complex instruments, test strategies under volatility, build confidence, and develop consistency before...

Schwab's Bitcoin options trading combines its trusted financial expertise with innovative crypto offerings, providing advanced tools, education, and regulatory compliance for both novice and experienced traders. By integrating Bitcoin ETF-based options into its platform, Schwab ensures accessibility, transparency, and risk...

Deribit is a leading crypto options trading platform specializing in Bitcoin and Ethereum derivatives, offering advanced tools, low-latency execution, deep liquidity, and user-friendly features for both novice and professional traders. Its robust technology, portfolio margining system, real-time analytics, and 24/7...

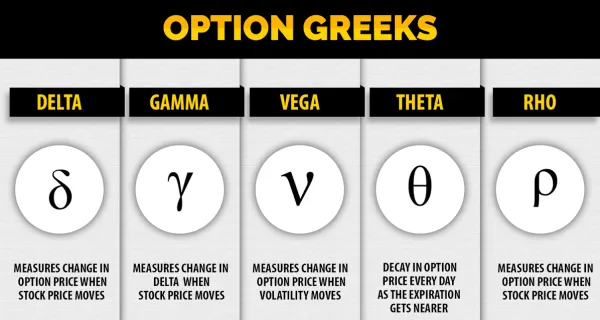

Option trading offers flexibility and strategic opportunities in various market conditions, relying on understanding call and put options as foundational tools. Mastering option chains, key metrics like strike price, premium, open interest, and implied volatility is essential for informed decision-making...

Laevitas is a cutting-edge platform for Bitcoin options trading, offering advanced analytics, predictive tools, and customizable dashboards to help traders make data-driven decisions efficiently. Its intuitive design and real-time insights empower users to identify opportunities, optimize strategies, and maintain a...

OKX Bitcoin Options offer traders flexibility, precision, and risk management tools with features like customizable strike prices, high liquidity, real-time analytics, and portfolio margining. The platform’s user-friendly design caters to both beginners and professionals while enabling strategic trading through various...

Daily expiry in Bitcoin options trading offers traders precision and flexibility to capitalize on short-term price movements, with lower premiums but higher timing demands. While it provides opportunities for quick profits through frequent settlements, its fast-paced nature requires disciplined strategies...

Crypto options trading offers flexibility and strategic opportunities by allowing traders to speculate on cryptocurrency price movements, hedge against market volatility, and potentially maximize gains through tools like inverse options; however, it requires navigating complex mathematical concepts and analyzing real-time...

Understanding the end time in option trading is crucial for determining when to exercise or let an option expire, impacting profitability and risk management. Effective timing strategies involve setting profit targets, using stop-loss orders, monitoring technical indicators, considering time decay,...