Posts on the Topic Greeks

Bybit’s crypto options platform offers a user-friendly, feature-rich environment for both beginners and pros to trade European-style contracts with robust liquidity. Setting up an account is straightforward, and the intuitive interface makes navigating option chains, placing trades, and managing risk...

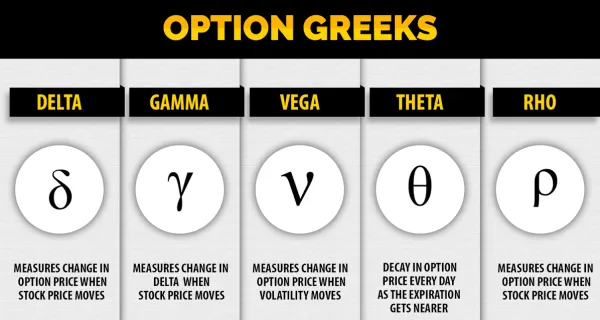

Option trading offers flexibility and strategic opportunities in various market conditions, relying on understanding call and put options as foundational tools. Mastering option chains, key metrics like strike price, premium, open interest, and implied volatility is essential for informed decision-making...

Option trading is a complex and high-leverage market activity that requires understanding of market conditions, risks, and continuous learning to navigate successfully. Education plays a critical role in achieving success by providing traders with the knowledge needed for informed decision-making...