Posts on the Topic Risk

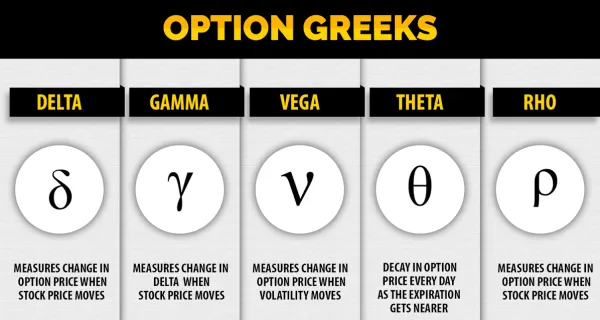

Option trading offers investors flexibility, leverage, and hedging opportunities in volatile markets, allowing for high returns with managed risk. It involves controlling large stock amounts with less capital and using various strategies adaptable to different market conditions and personal styles. Options...

Understanding option trading fundamentals is key to maximizing returns, involving knowledge of calls and puts, various strategies for different market conditions, and factors affecting profitability. Risk management through techniques like stop-loss orders and diversification is crucial in sustaining long-term option...

Option trading offline classes offer a structured approach for beginners to learn about options, calls, puts, market strategies, and risk management with direct engagement from experienced instructors. Choosing the right course involves considering personal learning needs and evaluating the provider's...

Option trading classes provide investors with the knowledge and skills to navigate options markets, offering structured curriculums and expert insights for both beginners and advanced traders. These courses cover everything from basic terminology to sophisticated strategies, emphasizing risk management and...

Option trading indicators are essential tools for analyzing market trends and making informed decisions, with different types serving various purposes such as trend identification and volatility measurement. While not foolproof, these indicators help traders predict market movements and refine their...

Bitcoin options leverage allows traders to increase their market exposure without increasing capital investment, potentially leading to greater returns. However, it also carries significant risks such as increased potential losses and liquidation risk due to the volatile nature of cryptocurrencies....