Posts on the Topic Options

Bitcoin Options DEX platforms offer decentralized, peer-to-peer trading of Bitcoin options with enhanced security, privacy, and lower fees by leveraging blockchain technology and smart contracts. These exchanges face challenges like liquidity issues and regulatory uncertainty but provide global accessibility and...

Understanding crypto options volume is essential for traders as it indicates market activity, sentiment, and liquidity; platforms like CoinGlass offer analytics to aid in strategic decision-making. Additionally, open interest provides insights into market strength and potential trends, while the CME...

Crypto options trading on decentralized exchanges (DEXs) offers enhanced security, privacy, and lower fees by leveraging blockchain technology for peer-to-peer transactions. Popular platforms like Hegic, Opyn, and Premia provide diverse features catering to different trading needs while ensuring transparency and...

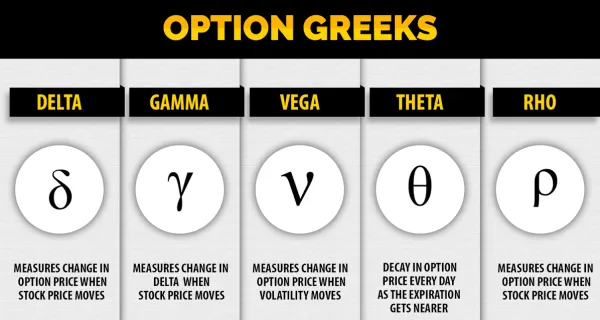

This article simplifies the basics of crypto options trading, explaining key concepts like call and put options, strike prices, and expiration dates. It highlights the advantages such as leverage, risk management, flexibility, cost-effectiveness, and profitability in various market conditions while...

Crypto options trading bots automate strategies to capitalize on market opportunities without constant monitoring, offering benefits like consistency, speed, data analysis, risk management, and 24/7 operation. Key features to look for include customizability, backtesting capabilities, robust security measures, an intuitive...

Ethereum Options Expiry is a critical concept in cryptocurrency trading, referring to the date and time when Ethereum options contracts expire, impacting market volatility, price discovery, risk management, and liquidity. Understanding these expiries helps traders anticipate market movements and adjust...

Ethereum binary options are a straightforward financial instrument allowing traders to speculate on Ethereum's price movements, offering fixed payouts for correct predictions and losses for incorrect ones. Their simplicity, high potential returns, controlled risk environment, and the ability to trade...

The article explains the fundamentals and strategies of Bitcoin options trading, detailing types of options like calls and puts, key components such as strategic planning, market analysis, risk management, leverage use, and performance monitoring. It emphasizes understanding market trends through...