Posts on the Topic Options

The article highlights the importance of Telegram channels for option trading, offering real-time information and strategies to help traders make informed decisions. It emphasizes that these channels are valuable communities providing expert analysis, educational resources, and a platform for interactive...

Option trading offline classes offer a structured approach for beginners to learn about options, calls, puts, market strategies, and risk management with direct engagement from experienced instructors. Choosing the right course involves considering personal learning needs and evaluating the provider's...

The article provides a beginner's guide to understanding the differences between cryptocurrency and options trading, highlighting that crypto trading involves buying and selling digital assets with high volatility while options trading allows speculation on asset prices through contracts without owning...

Option trading is a complex and high-leverage market activity that requires understanding of market conditions, risks, and continuous learning to navigate successfully. Education plays a critical role in achieving success by providing traders with the knowledge needed for informed decision-making...

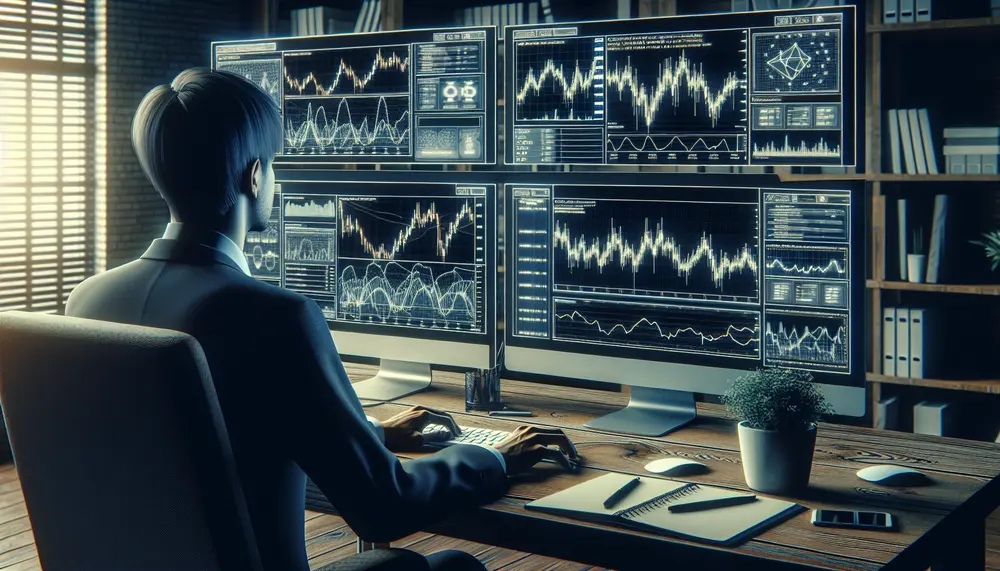

Option trading indicators are essential tools for analyzing market trends and making informed decisions, with different types serving various purposes such as trend identification and volatility measurement. While not foolproof, these indicators help traders predict market movements and refine their...

Option trading data is essential for informed decisions, encompassing market indicators like asset prices, volume, and volatility. Understanding these metrics helps traders identify trends and assess risk in the volatile cryptocurrency options market. Data analysis in option trading guides strategy development...

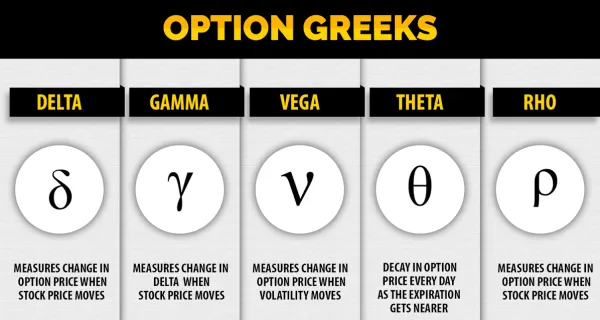

The article discusses the opportunities and benefits of option trading in the US market, highlighting its flexibility for speculation or hedging with leverage, and emphasizing the importance of understanding key concepts such as premiums, strike prices, expiration dates, intrinsic/extrinsic value,...