Posts on the Topic Bitcoin

Bitcoin Options ETFs offer flexible, nuanced diversification and income strategies by combining crypto exposure with options tactics like covered calls and spreads. These products enable tailored risk management, consistent income generation, and enhanced portfolio control without the complexities of direct...

Bitcoin Options DEX platforms offer decentralized, peer-to-peer trading of Bitcoin options with enhanced security, privacy, and lower fees by leveraging blockchain technology and smart contracts. These exchanges face challenges like liquidity issues and regulatory uncertainty but provide global accessibility and...

The article explains the differences between bitcoin options and futures, highlighting that while both are used for hedging and speculation in cryptocurrency markets, they differ significantly in terms of contractual obligations, risk exposure, profit potential, upfront costs, and market liquidity....

The article explains the fundamentals and strategic advantages of trading Bitcoin options, highlighting their role in risk management, cost efficiency, speculative opportunities, and income generation through premiums. It also outlines a step-by-step guide for beginners to start trading Bitcoin options...

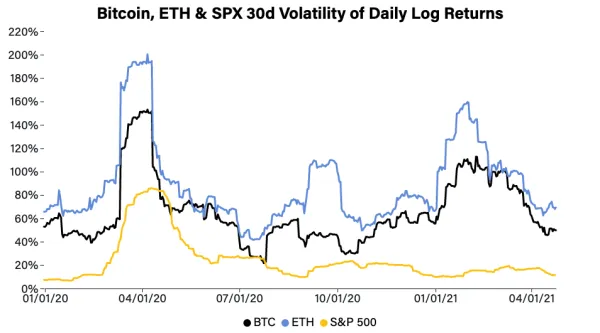

The article explains the fundamentals and strategies of Bitcoin options trading, detailing types of options like calls and puts, key components such as strategic planning, market analysis, risk management, leverage use, and performance monitoring. It emphasizes understanding market trends through...

The article discusses the factors that have contributed to the rise of Bitcoin as a major force in the global finance sector. These factors include increased institutional interest, technological advancements, changing economic scenarios, regulatory environments, macroeconomic factors, public perception, and...

The article discusses the investment opportunities and considerations between Ethereum and Bitcoin. It provides an introduction to cryptocurrencies and blockchain technology, explains the advantages and disadvantages of investing in Ethereum and Bitcoin, and highlights key aspects of investing in Ethereum,...

Bitcoin and Ethereum have had a significant impact on the financial landscape, reshaping traditional systems and introducing new possibilities. Their decentralized nature, fast and low-cost transactions, and innovative features like smart contracts have revolutionized banking, supply chain management, and digital...

Bitcoin Options ETFs offer flexible, nuanced diversification and income strategies by combining crypto exposure with options tactics like covered calls and spreads. These products enable tailored risk management, consistent income generation, and enhanced portfolio control without the complexities of direct...

Understanding Bitcoin option skew is essential for traders as it reflects market sentiment and potential price movements, aiding in risk management and strategy optimization by analyzing implied volatility differences between calls and puts....

Bitcoin option strategies are crucial for managing risks and optimizing returns in the volatile cryptocurrency market, offering flexibility through contracts that allow buying or selling Bitcoin at predetermined prices. Key strategies include Covered Call for income generation, Protective Put as...

Bitcoin options trading allows speculation on Bitcoin's future price without owning it, using contracts for buying or selling at a set price by a specific date; traders use call and put options to hedge against volatility or leverage market trends...

Bitcoin Options DEX platforms offer decentralized, peer-to-peer trading of Bitcoin options with enhanced security, privacy, and lower fees by leveraging blockchain technology and smart contracts. These exchanges face challenges like liquidity issues and regulatory uncertainty but provide global accessibility and...

A Bitcoin options trading strategy helps traders manage risk and capitalize on market movements by using contracts that offer the right, but not obligation, to buy or sell at a set price. Utilizing tools like strategy builders allows for precise...

Bitcoin binary options brokers allow traders to speculate on Bitcoin's price movement within a set timeframe, offering either fixed returns or losses. Choosing the right broker is crucial for security, fair trading conditions, and support; factors like regulation, reputation, platform...

Robinhood is democratizing Bitcoin options trading by offering a user-friendly interface, educational resources, low-cost trading, and real-time market data. This initiative aims to make advanced trading techniques accessible to everyone, including beginners with limited experience....

Understanding Bitcoin options in Canada involves learning about their use as financial instruments that allow trading on Bitcoin's price movements without owning the cryptocurrency, and recognizing they are complex with high risk suitable for experienced investors. Additionally, it is crucial...

The article explains the differences between bitcoin options and futures, highlighting that while both are used for hedging and speculation in cryptocurrency markets, they differ significantly in terms of contractual obligations, risk exposure, profit potential, upfront costs, and market liquidity....

Bitcoin options trading involves buying derivatives that allow the trader to purchase or sell bitcoin at a predetermined price before a specific date, with call and put options being the primary types. Successful trading requires understanding market conditions and choosing...

Bitcoin options are financial derivatives allowing the buyer to purchase or sell Bitcoin at a set price before a specific deadline, used for hedging against market volatility. Understanding these options involves knowing terms like premium and moneyness, while trading them...

The article explains the fundamentals and strategic advantages of trading Bitcoin options, highlighting their role in risk management, cost efficiency, speculative opportunities, and income generation through premiums. It also outlines a step-by-step guide for beginners to start trading Bitcoin options...

Bitcoin options are financial derivatives allowing the holder to buy or sell bitcoins at a predetermined price on a specific date, used by traders to hedge against volatility or speculate on future prices. Historical data in bitcoin options trading is...

Fidelity offers a platform for trading Bitcoin options, which are financial derivatives allowing investors to buy or sell Bitcoin at a predetermined price before a specific date. This service includes robust security, comprehensive market data, and educational resources to aid...

Bitcoin options trading allows investors to buy or sell Bitcoin at a predetermined price on a specific date, offering strategies like hedging against market volatility without owning the actual asset. Traders must meet certain criteria such as identity verification and...

The article explains the fundamentals and strategies of Bitcoin options trading, detailing types of options like calls and puts, key components such as strategic planning, market analysis, risk management, leverage use, and performance monitoring. It emphasizes understanding market trends through...

The article provides an introduction to real-time Bitcoin options trading, explaining how these financial derivatives allow traders to buy or sell Bitcoin at a predetermined price within a specific timeframe. It highlights the importance of understanding market dynamics and using...

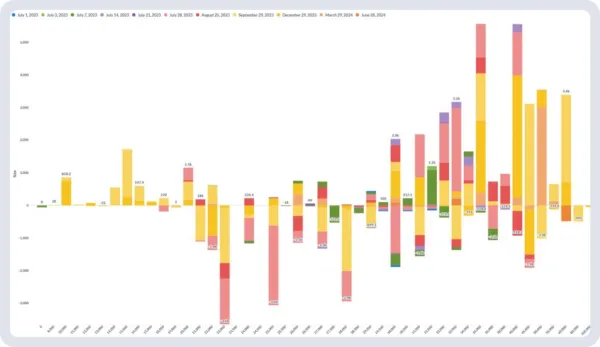

Bitcoin options trading offers investors the ability to manage risk or speculate on Bitcoin's future prices through contracts that allow buying or selling at predetermined prices within a set timeframe. Advanced analytics enhance strategic decision-making in this volatile market by...

Bitcoin options trading accounts allow traders to speculate on bitcoin's price movement with limited risk and potential for high returns, using financial derivatives that can be executed strategically. It is essential to understand the mechanics of options trading, such as...

The article explains the concept of the "Bitcoin Miners Exodus," referring to the mass departure of Bitcoin miners from certain regions due to regulatory changes or other challenges. It discusses the impact of this exodus on the Bitcoin market, the...

This article explains the concept of the Bitcoin Adoption Curve, which represents the mainstream market penetration of Bitcoin. It discusses the different stages of adoption, the potential pros and cons, and factors that influence Bitcoin adoption. The article concludes by...

The Bitcoin Mempool is where all transaction data accumulates before miners confirm them, and it is an indicator of how congested the Bitcoin network is. Understanding the dynamics of the Mempool can help options traders predict transaction times and fees,...

Bitcoin's value is heavily influenced by human psychology, with market sentiment, fear of missing out (FOMO), greed, and emotional factors playing a significant role. Understanding these factors is crucial for anyone engaging in Bitcoin trading. Market sentiment, which refers to...

Bitcoin ETFs are investment vehicles that allow investors to access the Bitcoin market without actually owning the cryptocurrency. These ETFs can potentially increase liquidity, boost the value of Bitcoin, and enhance the legitimacy of cryptocurrencies. Different trading strategies for Bitcoin...

The controversy surrounding Bitcoin's energy consumption has implications for investors, particularly options traders. The debate focuses on the significant energy consumed by Bitcoin mining, with critics arguing that it contributes to the climate crisis while proponents claim it is justified...

The article discusses the evolution of Bitcoin ownership from its early days with Satoshi Nakamoto and early adopters to the current state with institutional investors. It explores the pros and cons of this evolution and how it has shaped the...

The Bitcoin Lightning Network is a gamechanger in cryptocurrency trading, allowing for faster and cheaper Bitcoin transactions by operating offchain via state channels. It offers speed, scalability, and new trading strategies, making it crucial for traders to understand and adapt...

Bitcoin Halving is a preprogrammed event that occurs approximately every four years, reducing the rewards for miners who maintain the network and process transactions. It is designed to limit the supply of new Bitcoins and potentially drive up the price...

The article discusses the factors that have contributed to the rise of Bitcoin as a major force in the global finance sector. These factors include increased institutional interest, technological advancements, changing economic scenarios, regulatory environments, macroeconomic factors, public perception, and...

The article discusses the investment opportunities and considerations between Ethereum and Bitcoin. It provides an introduction to cryptocurrencies and blockchain technology, explains the advantages and disadvantages of investing in Ethereum and Bitcoin, and highlights key aspects of investing in Ethereum,...

Bitcoin Technical Analysis is a specialized field that uses historical trading data and indicators to predict the future price movements of Bitcoin. Understanding trends, volume, price levels, and market indicators can help traders make informed decisions in the volatile cryptocurrency...

Bitcoin and Ethereum have had a significant impact on the financial landscape, reshaping traditional systems and introducing new possibilities. Their decentralized nature, fast and low-cost transactions, and innovative features like smart contracts have revolutionized banking, supply chain management, and digital...

The article discusses the comparison between Bitcoin and Ethereum as investment options in the world of cryptocurrencies. It highlights the unique features and potential of each cryptocurrency and provides insights into their market dominance, security, scalability, and utility. The article...

In this article, the author explores the importance of understanding Bitcoin chart patterns in order to predict future price movements and make informed trading decisions. They discuss common chart patterns such as the Head and Shoulders, Double Top and Double...

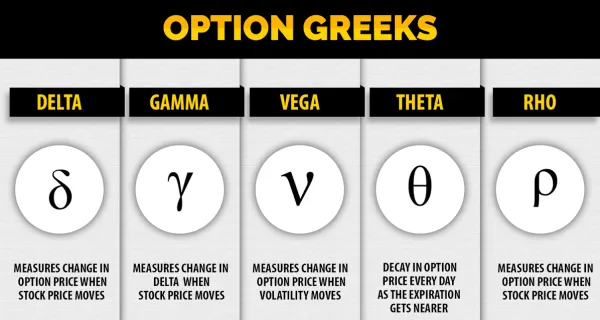

The Greeks are essential tools in the world of crypto options trading used to quantify risk and optimize returns. They measure different dimensions of risk, including sensitivity to the underlying price, acceleration of price changes, time decay, volatility, and interest...

YouTube is a popular video-sharing platform on the internet that offers a wide variety of videos for people to watch and enjoy, free of charge. It also provides tools for users to create and share quality content and a user-friendly...

Top 10 posts in the category

Unsere Beiträge zum Thema Bitcoin

Discover the fascinating world of Bitcoin options trading and unlock the potential of this revolutionary digital currency. As the leading cryptocurrency, Bitcoin offers a unique opportunity for traders to engage in a vibrant and rapidly evolving market. Our curated articles provide in-depth insights and strategies tailored to both novices and experienced traders looking to navigate the options trading landscape with Bitcoin.

Understanding Bitcoin options trading can be the key to capitalizing on market movements and managing risk effectively. By exploring our comprehensive guides and tutorials, readers gain a thorough grasp of different trading techniques, the importance of volatility in the market, and how to use Bitcoin options to hedge against potential losses.

Dive into the rich ecosystem of Bitcoin and explore various trading platforms and tools that can enhance your trading experience. Each article is designed to equip you with the knowledge required to make informed decisions, understand market trends, and implement strategies that align with your investment goals when dealing with Bitcoin options.

By investing your time in reading the valuable content available in our Bitcoin category, you stand to gain the edge needed to thrive in the dynamic world of cryptocurrency options. Whether you're aiming to broaden your understanding of Bitcoin derivatives or looking to refine your trading tactics, our expertly crafted content is your gateway to becoming a proficient Bitcoin options trader.