Table of Contents:

Introduction

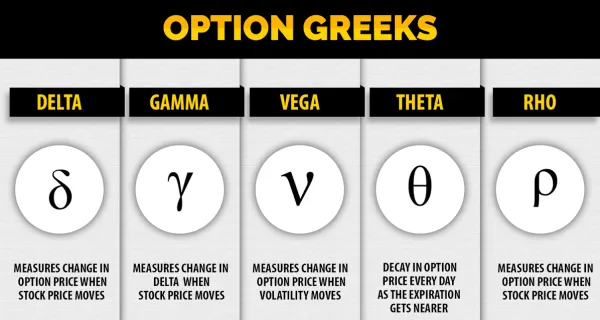

In the world of crypto options trading, understanding the Greeks is key to successfully managing risk and optimizing returns. Named after Greek letters, the Greeks represent various dimensions of risk involved in taking an options position. They are crucial tools used by traders to gauge the sensitivity of an option's price to different factors. This article will provide a simplified explanation of the primary Greeks: Delta, Gamma, Theta, Vega, and Rho.

Delta: Sensitivity to Underlying Price

Delta measures how much an option's price is expected to change for a $1 change in the price of the underlying asset. It ranges between -1 and 1 for calls and puts. If a call option has a Delta of 0.6, the option's price will rise by approximately 60 cents if the underlying asset increases by $1.

Greeks in Crypto Options Trading

| Pros | Cons |

|---|---|

| Delta can help predict future price changes. | Gamma demonstrates a higher risk as it can amplify losses during periods of high volatility. |

| Vega indicates how much an option's price changes in relation to changes in the volatility of the underlying asset. | Vega can also instigate losses when the volatility decreases. |

| Theta provides valuable insights into the effect of time decay on options. | Theta signifies that the value of an option decreases over time. |

| Rho gives information about the sensitivity of an option to changes in the interest rate. | Rho is generally not a major concern for short-term options traders. |

Gamma: Acceleration of Delta

Gamma measures the rate of change in Delta for a $1 change in the price of the underlying asset. It essentially gauges the acceleration of an option's price change. When Gamma is high, small changes in the asset's price can significantly impact the Delta, hence the option's price.

Theta: Time Decay

Theta represents the rate of decrease in an option's value due to the passage of time, all else being equal. Theta is often referred to as time decay, and it tends to accelerate as an option approaches expiration. Traders need to keep a keen eye on Theta, especially when dealing with short-term options.

Vega: Sensitivity to Volatility

Vega measures the expected change in an option's price for a 1% change in the implied volatility of the underlying asset. Since crypto markets are notoriously volatile, Vega is particularly relevant in crypto options trading. An increase in volatility often leads to an increase in options prices, making Vega an important Greek for options traders to monitor.

Rho: Interest Rate Risk

Rho gauges the sensitivity of an option's price to changes in the interest rate. It's generally less relevant for crypto options as cryptocurrencies tend not to be interest rate-sensitive.

Conclusion

Understanding the Greeks is essential in options trading, allowing traders to quantify risk and make more informed decisions. While the concept of Greeks may seem complex, they become more intuitive with experience. Bitopex offers a user-friendly trading platform where you can apply your understanding of the Greeks to real-world trading scenarios.

Remember, all trading involves risk, and you should only invest what you can afford to lose. Always conduct thorough research and consider seeking advice from financial advisors before delving into crypto options trading.

Understanding the Greek Parameters in Cryptocurrency Options Trading

What are the Greeks in options trading?

The Greeks are a set of statistical values that provide a way to measure the sensitivities of an option’s price to various factors such as the underlying asset price, volatility, time until the option's expiration, and interest rates.

What is Delta in crypto option trading?

In the context of options trading, Delta is a measure of how the price of an option is expected to change relative to the change in the price of the underlying cryptocurrency.

What does the Greek Theta represent in crypto options?

Theta represents the rate at which the option’s price is expected to decrease for each day that passes, holding all other factors constant. This measures an option's time decay.

What is Vega in cryptocurrency options trading?

Vega measures the option's price sensitivity to changes in the volatility of the underlying asset. It represents the amount an option's price will change for every 1% change in the underlying asset’s implied volatility.

How does Gamma affect my crypto options position?

Gamma measures the rate of change for an option's delta in response to a change in the price of the underlying asset. This helps option traders to adjust hedging activities.