- DeFi options enhance market liquidity by allowing more participants to hedge or speculate on asset prices.

- They provide increased financial inclusion by giving access to financial instruments without traditional barriers.

- DeFi options enable more complex investment strategies through permissionless and transparent smart contracts.

Yo guys, I've been thinking a lot about this DeFi thing recently. It's been touted as the next big evolution for the crypto market, right? So, what's the deal with it? What makes it so special, and what kind of benefits does it bring to the crypto market? Any of you crypto gurus care to enlighten us?

Totally get your perspective, but have you guys thought about the security risks in DeFi? Isn't it a bit like walking a high wire without a safety net?

It's always a good idea to do some digging and understand the potential risks before diving head-first into DeFi. Smart contracts aren't infallible and there's no bailout if something goes sideways.

Uh huh, and what about those gas fees though? Ain't nobody got time for that.

And guys, don't start me on the scalability issues. If DeFi really wants to compete with traditional finance, it's got to find a way to handle high volumes and fast transactions, no two ways about it.

Sure, DeFi has it challenges and we can't simply gloss over them. However, I think it's without doubt that the amount of disruption and opportunity it's presenting is worth a few growing pains. If we can figure out a way to navigate its risks and limitations, the upside potential it’s presenting to democratize finance is massive. It's still early days and we're all pioneers here. Just remember, every rose has its thorns, my friends.

Chill guys, let\'s not forget that Rome wasn\'t built in a day. DeFi has its quirks, but most disruptive technologies do in their early stages, don\'t they?

You're right on the money there, and let's not sidestep that along with these challenges comes the exhilarating possibility of making a profound impact. The bottom line is, DeFi is throwing open doors that were previously locked and bolted. Now, that's sure as shootin' worth a bit of turbulence. Let's watch this space!

Have we considered the impact of government regulation on DeFi in crypto space? Any thoughts?

Good point. That's a whole new can of worms. Crypto has, traditionally, been seen as a bit of a renegade, but with DeFi, we're seriously breaking new ground. It's like dancing on a tightrope, if you ask me. Thoughts, anyone?

Absolutely true, it's a fine balancing act, and I reckon we're up for the challenge!

Seems like we've covered a lot, but don't overlook community governance in DeFi—it empowers users but comes with complexities. Always worth getting a pulse on the community sentiment and being involved.

For sure! The potential of programmable, automated trading strategies in DeFi cannot be understated; it's a game-changer for the proactive and tech-savvy amongst us.

Absolutely, and let's not skim over the interoperability DeFi brings to the table. Being able to seamlessly move assets across different blockchains is like having a magic key to every door in the financial ecosystem. It's a big leap towards a more connected and efficient future in finance. What are your takes on this cross-chain wizardry?

Just tuning in here, another aspect might be the innovation in financial products that DeFi introduces. Things like yield farming and liquidity mining are concepts traditional finance can't match at the moment. It's really reshaping what we think is possible in terms of earning on investments.

- How does technical chart analysis differ in option trading with cryptocurrencies compared to other traditional assets? 5

- How can chart analysis be used to optimize option trading with cryptocurrencies? 4

- Are there any specific risk management techniques for trading crypto options? 3

- What strategies can I employ when trading DeFi crypto options? 11

- What are the most effective charting patterns for predicting price movements in options trading with cryptocurrencies? 4

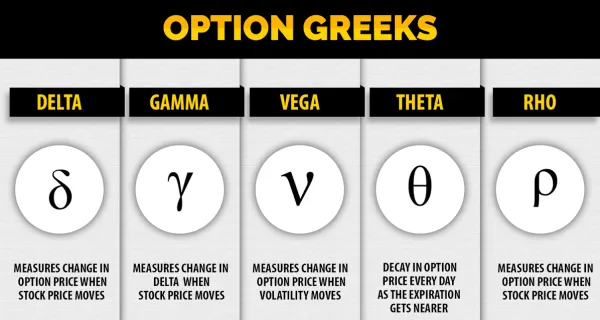

- What is Rho and how does it impact options pricing? 9

- How do you manage to stay objective and not let bias affect your chart analysis? 5

- What timeframes are most relevant for options trading in the crypto market? 23

- How can chart analysis be used to determine the optimal time to enter or exit a position when trading options with cryptocurrencies? 3

- Can chart analysis alone be sufficient to make informed decisions when trading options with cryptocurrencies? 3

- How can Fibonacci retracement and extension levels aid in predicting future price movements in the crypto options market? 241

- What is the concept of 'rolling' an option in crypto options trading, and when is it advantageous to use this strategy? 233

- How do the Greeks differ for call options vs put options? 227

- How can I implement 'collar' strategies in crypto options to protect my portfolio against significant losses? 226

- How does the 'covered call' strategy work in the context of crypto options trading, and when should it be used? 225

- How can technical indicators be used in options trading? 220

- How can I use 'spread' strategies like bull call spreads, bear put spreads, iron condors, and butterfly spreads in crypto options trading? 212

- Can you explain the terms 'call option' and 'put option' in the context of cryptocurrency? 211

- How can I integrate fundamental analysis with chart analysis to optimize my trading strategy in crypto options? 202

- Are there any specific books or resources you'd recommend for understanding options trading better? 201

Blog Posts | Current

Crypto Options Expiry: Timing, Impact, and Strategies

Trading with cryptocurrencies may seem challenging, with terms like the Crypto Options Expiry often throwing beginners off track. In this...

Bitopex Guide: Fibonacci Retracements in Crypto Chart Analysis

Introduction to Fibonacci Crypto Analysis Embarking on the journey to understand the world of cryptocurrencies and their market behavior can initially...

Liquidity in Bitcoin Options: Key Factors and Strategies

Introduction to Bitcoin Options and LiquidityTrading in the realm of cryptocurrencies has broadened considerably in recent years, with Bitcoin options...

Demystifying the Greeks in Crypto Options Trading

Introduction In the world of crypto options trading, understanding the Greeks is key to successfully managing risk and optimizing returns. Named...

A Beginner's Guide to Options Trading in Crypto

Introduction - A Beginner's Peek into the World of Crypto Options Trading The world of cryptocurrencies is not limited to buying...

Mastering Chart Analysis: Tips and Tricks for Crypto Enthusiasts

Welcome to another value-packed article on Bitopex. Our goal remains to demystify the world of cryptocurrency trading, helping you navigate...

Welcoming You to Bitopex's New Blog and Forum: A Powerhouse of Crypto Options Knowledge and Engagement

Hello dear members, enthusiasts, and newcomers, We are elated to announce the launch of Bitopex's new blog and forum - an...

Step-by-Step: Your First Crypto Options Trade

In the world of digital finance, the ability to navigate the terrain of cryptocurrency options trading can make a significant...

Crypto Options 101: A Comprehensive Guide for Beginners

In an evolving digital world, cryptocurrency has become more than just a trend. It's a financial cusp heralding an era...

Ethereum's Flash Crashes: Causes, Consequences, and Coping Strategies

Introduction: Understanding Ethereum Flash Crashes A critical phase of investing in cryptocurrencies, such as Ethereum, involves understanding the sudden drops in...