Introduction to Fibonacci Crypto Analysis

Embarking on the journey to understand the world of cryptocurrencies and their market behavior can initially feel overwhelming. That’s where tools like the Fibonacci Retracement come into play. The Fibonacci Crypto Analysis presents an effective path to understanding market trends and predicting future price movements.

The creation by a 13th-century mathematician, Fibonacci retracements, have found vital applications in today's financial markets, including the rapidly evolving cryptocurrency sector. This tool is not limited to elite investors alone. Any individual, even with limited knowledge of crypto dynamics, can leverage Fibonacci retracements to make well-informed investment decisions.

The primary aim of this guide is to simplify the application of Fibonacci retracements in crypto chart analysis. Let's start with understanding what Fibonacci retracements are and how they could be an integral part of your investment strategy.

Understanding Fibonacci Retracements

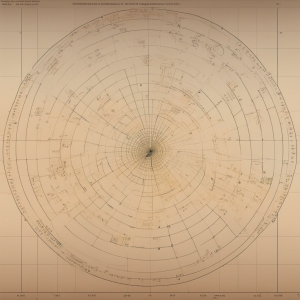

The staircase-like sequence that constitutes Fibonacci numbers consists of numbers, where each is the sum of the two preceding ones. This sequence begins with 0 and 1, and continues 1, 2, 3, 5, 8, 13, and so forth.

The key detail in any Fibonacci Crypto Analysis lies in the ratios derived from these numbers. The significant ones are 0.618, 0.382, and 0.236 - famously known as the Golden Ratio, representing natural symmetry in many real-world structures.

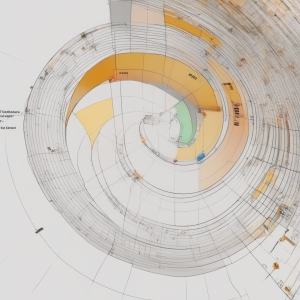

In financial chart analysis like cryptocurrencies, Fibonacci retracements plot horizontal lines to indicate where support and resistances are likely to occur. They are based on the Fibonacci ratios and are plotted between high and low points on a chart. Each level represents a potential reversal zone where price action is expected to pause or reverse.

So, how are these levels correlated with the crypto market? Let's find out.

Fibonacci Retracements Pros and Cons in Crypto Chart Analysis

| Pros | Cons |

|---|---|

| Helps identify potential reversal levels | Not always accurate, results can be subjective |

| Based on natural mathematical phenomenon | Needs a clear high and low point, which can be subjective |

| Used widely, enhancing its reliability | Might not work well in highly volatile markets |

| Can be used in conjunction with other indicators to increases chances of success | Does not provide timing for trades |

The Importance of Fibonacci Levels in Crypto Trading

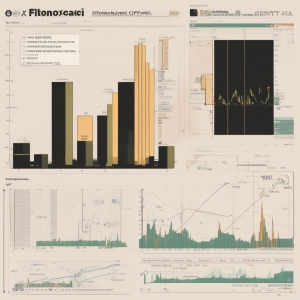

Now, you might be wondering, what makes these Fibonacci levels essential in the realm of crypto trading? These levels, defined by the Fibonacci ratios, not only sketch the path of a price chart but provide invaluable insights into possible future trends.

In the volatile and fast-paced world of cryptocurrencies, being one step ahead is crucial for success. Understanding where the price might inflect or stabilize equips traders with a significant advantage. Cryptocurrency prices have a reputation for steep ups and downs. This means they often reach and bounce back from these Fibonacci retracement levels. Clued up traders and investors commonly use Fibonacci retracements as part of their crypto analysis toolkit.

Essentially, the Fibonacci retracement serves as a predictive tool, assisting in identifying promising buying and selling points. For example, when the price of a cryptocurrency dips, a common mistake is to panic sell. However, if this dip reaches a Fibonacci level, it could signal that the price is about to rise again. So, in this case, it could be a perfect opportunity to buy low before the price soars.

Despite being no guarantee, it’s a fairly reliable indicator based on rational mathematical principles. Therefore, utilizing Fibonacci retracements in crypto trading can give you a solid ground to carefully plan and execute trades.

Mastering Fibonacci Crypto Analysis might give your trading strategy an edge over others. But, how do you apply these principles to a crypto chart and read its predictions? Don't worry. We'll guide you through it in the next section =,

How to Apply Fibonacci Retracements on Crypto Charts

Applying Fibonacci retracements to your crypto charts is a process that demands precision, but remains quite straightforward.

Firstly, identify the most recent major peak and trough on your chart. The peak is the highest point the price has reached, while the trough is the lowest.

To plot the Fibonacci levels, draw a line from the peak to the trough. The essential Fibonacci ratios (23.6%, 38.2%, 61.8%) will automatically appear on your chart as horizontal lines. These three levels are now your potential resistance and support levels, illustrating where price might face hurdles or regain strength. Sometimes, traders also include 50% level although it's not officially a Fibonacci ratio.

For uptrends, the line should be drawn from the trough to the peak, representing potential support levels below the current price. Conversely, for downtrends, the line is drawn from peak to trough, reflecting possible resistance levels above the current price.

Fibonacci retracement tools are readily available on most trading platforms, including those popular among crypto traders. This makes it easy to add them to your charts and customize according to your preferences.

While using Fibonacci Crypto Analysis, keep in mind that it’s more of an art than an exact science. Its efficiency increases when used in combination with other indicators and technical analysis tools.

Another common technique is to look for ‘confluence’ - areas where different Fibonacci retracement levels from different peaks and troughs overlap, indicating a particularly strong potential resistance or support level.

To master this tool, practice it consistently on different cryptocurrency charts until you are comfortable with its predictions.

Finding Value with Fibonacci Retracements

The beauty of Fibonacci retracements lies in its ability to help traders assess the value of a cryptocurrency. Unlike mainstream financial markets with tangible assets, valuing cryptocurrencies can be a tough nut to crack.

This is where Fibonacci Crypto Analysis shines. By tracking how a cryptocurrency's price responds to the Fibonacci levels, traders can appraise the crypto's real-world worth. How A crypto bounces back from these levels is a valuable indicator of its market sentiment. For instance, a cryptocurrency that bounces back confidently from a major retracement level may represent a strong buy signal to traders.

Moreover, traders may also combine Fibonacci retracement with other signals in technical analysis to form a more solid trading strategy, for instance, candlestick patterns or indicators like Moving Average Convergence Divergence (MACD). Such a combination allows for more robust evaluations and decisions.

Given the flexibility and accuracy of Fibonacci retracements, it is not uncommon for their adoption in the crypto trading community. Thus, finding value in markets as dynamic as cryptocurrencies can be less daunting with a thorough understanding of Fibonacci retracements.

Building Successful Crypto Trading Strategies with Fibonacci

Once you're comfortable with applying Fibonacci retracements on crypto charts, the next step is to integrate them into your broader trading strategy. The main strength of Fibonacci retracements lies in their versatility. They can be used either as a standalone method of analysis or as a supplement to other technical analysis tools.

In a trending market, it's common to use Fibonacci retracements in conjunction with trend lines to identify potential buy zones during uptrends and sell zones during downtrends. It’s important to remember, strong trends tend to retrace to shallower levels such as 23.6% or 38.2%, while weaker trends might retrace as much as 61.8%.

You can also use Fibonacci levels to set your stop loss and take profit targets. For example, if you're buying on a pullback and anticipate a new high, the 161.8% level (an extension of the Fibonacci sequence) can serve as a natural take profit target. Conversely, a stop-loss order can be placed slightly below a Fibonacci support level in case the market moves against your position.

Regardless of how you use Fibonacci retracements in your trading, remember to consider the broader market context, stay disciplined in your approach, and manage your risks effectively. In the fast-paced, volatile world of crypto trading, Fibonacci retracements provide a systematic, calculated approach to entry, exit, and risk management strategies.

By mastering the technique of Fibonacci Crypto Analysis, traders can position themselves better, heightening the prospects of successful results in their trading endeavors. Such insights can help transform unpredictable crypto highs and lows into more strategic moves that can be the difference in making the most or losing out in the world of digital currency investment.

Conclusion: The Power of Fibonacci for Crypto Analysis

In the world of cryptocurrencies, predicting market trends seems like a mammoth task. However, with the help of sophisticated yet simple tools like Fibonacci retracements, it becomes manageable.

Adopting Fibonacci retracements in your crypto trading strategy can significantly enhance your understanding of price movements. These support and resistance levels drawn from golden ratios provide possible entry and exit points, thus empowering investor decisions.

While no prediction tool is flawless and guarantees absolute success, the systematic nature of Fibonacci retracements renders them trustworthy. Remember, the effectiveness of Fibonacci Crypto Analysis lies in its correct application and consistent practice.

Therefore, let the Fibonacci magic give you a calculated anticipation of the markets next move and boost your crypto trading journey. Embrace the bulls, befriend the bears, and let these golden ratios guide your way to successful crypto investing.

Understanding Fibonacci Retracements in Crypto Chart Analysis

What is Fibonacci retracement in crypto chart analysis?

Fibonacci retracement refers to horizontal lines that indicate where support and resistance are likely to occur. They are calculated based on Fibonacci numbers, a sequence of numbers where each number is the sum of the two preceding ones.

How are Fibonacci retracement levels calculated?

The main levels are derived through a series of mathematical calculations of horizontal distances from the high and low price levels of the selected time frame.

How to use Fibonacci retracement for crypto trading?

When a crypto coin shows a strong uptrend, it can potentially continue its rise after a short-term pullback. Fibonacci retracement lines can help traders determine when to enter or exit a trade, based on the potential resistance and support levels.

What are the common retracement levels?

Common Fibonacci retracement levels include 23.6%, 38.2%, 50.0%, 61.8% and 78.6%.

Why use Fibonacci retracements in crypto chart analysis?

Fibonacci Retracements provide a way to identify potential reversal levels, provide set-up conditions for trades, and offer points to take profits. They are based on the mathematical concept of the Golden Ratio, which creates a sense of balance and proportion in the markets.