Are there any books or e-books you'd recommend that complement online options trading tutorials?

» Tutorials- "Option Volatility and Pricing" by Sheldon Natenberg provides a solid foundation on option theory and different trading strategies.

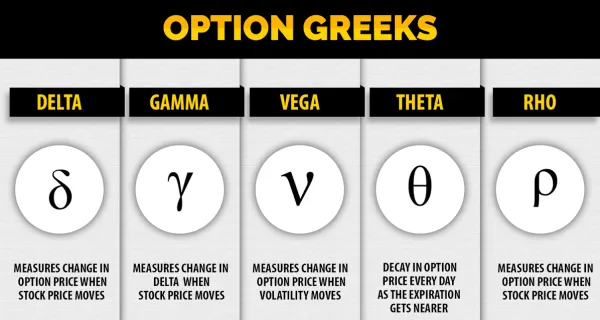

- "Trading Options Greeks: How Time, Volatility, and Other Pricing Factors Drive Profits" by Dan Passarelli focuses on the practical application of options trading Greeks.

- "The Options Playbook" by Brian Overby offers a variety of options strategies with real-world examples suitable for beginners and experienced traders.

Yo peeps, so here's the deal. I've been getting stuck into those online options trading tutorials. They're legit and all but I feel like I need something more, ya know? Like a book or e-book that really gets into the nitty-gritty stuff. Maybe stuff that talks about the more complex topics or even some hidden secrets that only the experts know about. You got anything bang on that would help me out with this? Cool beans, cheers!

That's a deep dive, guys. Did anyone consider the impact of high-frequency trading on our strategies? Are the pros and cons here equally compelling or is one side outweighing the other?

Really? I'm not so sure about that, guys. I mean, isn't high-frequency trading more about speed than strategy?

Hmmm, gotta say, I'm not buying this whole high-frequency trading thing. Feels like running a marathon on ice to me. You guys got solid numbers showing it pulls ahead in the long run? Or is this another "get-rich-quick" myth floating around? Would be rad to hear your thoughts.

Okay, but have we really dug into the tech side of this? Isn't the hardware, software, and even the physical location critical in high-frequency trading? What about those hidden operational costs? Just tossing it out there!

Just a quick thought from my side: don't forget taxes and possible legal issues associated with high-frequency trading. Remember, IRS and SEC won't be your pals if you ignore them.

Psh, just sounds like a fancier roulette wheel to me, guys. Risky business, this high-frequency stuff.

Alright, I'm following all this high-frequency talk, but how do we know when it's time to jump ship? Is there a magic "red flag" moment we should look out for?

Hmm, I\'m curious about what success rate traders actually have with this high-frequency stuff. Is it really as profitable as it\'s cracked up to be, or are we just seein\' the winners and not the pile of folks who lost their shirts?

Absolutely, it's crucial to get into the specifics of a successful strategy for high-frequency trading. Keep in mind, beyond the tech and strategies, it's all about managing your risk and expectations. Maybe start small, test the waters with controlled trades to understand how high-frequency strategies work in real-time without committing a major part of your portfolio. Also, continued learning and adapting are key since the market conditions change rapidly. What about algorithms? Anyone delved into developing personal trading algorithms that can adapt and learn over time?

- How can chart analysis be used to optimize option trading with cryptocurrencies? 4

- Are there any specific risk management techniques for trading crypto options? 3

- What strategies can I employ when trading DeFi crypto options? 11

- What are the most effective charting patterns for predicting price movements in options trading with cryptocurrencies? 4

- What is Rho and how does it impact options pricing? 9

- How do you manage to stay objective and not let bias affect your chart analysis? 5

- What timeframes are most relevant for options trading in the crypto market? 23

- How can chart analysis be used to determine the optimal time to enter or exit a position when trading options with cryptocurrencies? 3

- Can chart analysis alone be sufficient to make informed decisions when trading options with cryptocurrencies? 3

- How can I stay updated with the latest news and developments in the crypto options market? 2

- How can Fibonacci retracement and extension levels aid in predicting future price movements in the crypto options market? 241

- What is the concept of 'rolling' an option in crypto options trading, and when is it advantageous to use this strategy? 233

- How do the Greeks differ for call options vs put options? 227

- How can I implement 'collar' strategies in crypto options to protect my portfolio against significant losses? 226

- How does the 'covered call' strategy work in the context of crypto options trading, and when should it be used? 225

- How can technical indicators be used in options trading? 220

- How can I use 'spread' strategies like bull call spreads, bear put spreads, iron condors, and butterfly spreads in crypto options trading? 212

- Can you explain the terms 'call option' and 'put option' in the context of cryptocurrency? 211

- How can I integrate fundamental analysis with chart analysis to optimize my trading strategy in crypto options? 202

- Are there any specific books or resources you'd recommend for understanding options trading better? 201

Blog Posts | Current

Mastering Chart Analysis: Tips and Tricks for Crypto Enthusiasts

Welcome to another value-packed article on Bitopex. Our goal remains to demystify the world of cryptocurrency trading, helping you navigate...

Ethereum's Flash Crashes: Causes, Consequences, and Coping Strategies

Introduction: Understanding Ethereum Flash Crashes A critical phase of investing in cryptocurrencies, such as Ethereum, involves understanding the sudden drops in...

Liquidity in Bitcoin Options: Key Factors and Strategies

Introduction to Bitcoin Options and LiquidityTrading in the realm of cryptocurrencies has broadened considerably in recent years, with Bitcoin options...

Step-by-Step: Your First Crypto Options Trade

In the world of digital finance, the ability to navigate the terrain of cryptocurrency options trading can make a significant...

Crypto Options Expiry: Timing, Impact, and Strategies

Trading with cryptocurrencies may seem challenging, with terms like the Crypto Options Expiry often throwing beginners off track. In this...

Welcoming You to Bitopex's New Blog and Forum: A Powerhouse of Crypto Options Knowledge and Engagement

Hello dear members, enthusiasts, and newcomers, We are elated to announce the launch of Bitopex's new blog and forum - an...

A Beginner's Guide to Options Trading in Crypto

Introduction - A Beginner's Peek into the World of Crypto Options Trading The world of cryptocurrencies is not limited to buying...

Demystifying the Greeks in Crypto Options Trading

Introduction In the world of crypto options trading, understanding the Greeks is key to successfully managing risk and optimizing returns. Named...

Bitopex Guide: Fibonacci Retracements in Crypto Chart Analysis

Introduction to Fibonacci Crypto Analysis Embarking on the journey to understand the world of cryptocurrencies and their market behavior can initially...

Crypto Options 101: A Comprehensive Guide for Beginners

In an evolving digital world, cryptocurrency has become more than just a trend. It's a financial cusp heralding an era...