Posts on the Topic Volatility

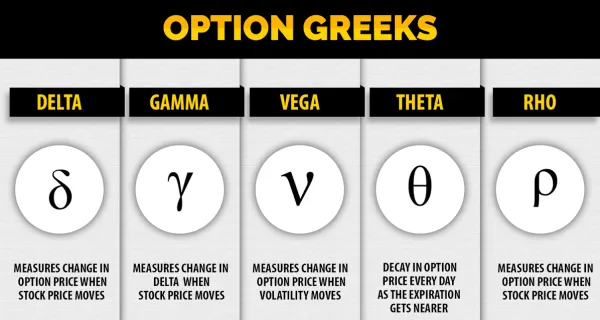

Option trading in Germany offers investors the opportunity to diversify their portfolios and manage larger assets with less capital, using regulated exchanges for transparency. Traders can use options for hedging, speculation, or income generation by understanding market indicators and terminologies;...

The article provides a beginner's guide to understanding the differences between cryptocurrency and options trading, highlighting that crypto trading involves buying and selling digital assets with high volatility while options trading allows speculation on asset prices through contracts without owning...

Option trading is a complex and high-leverage market activity that requires understanding of market conditions, risks, and continuous learning to navigate successfully. Education plays a critical role in achieving success by providing traders with the knowledge needed for informed decision-making...

Option trading classes provide investors with the knowledge and skills to navigate options markets, offering structured curriculums and expert insights for both beginners and advanced traders. These courses cover everything from basic terminology to sophisticated strategies, emphasizing risk management and...

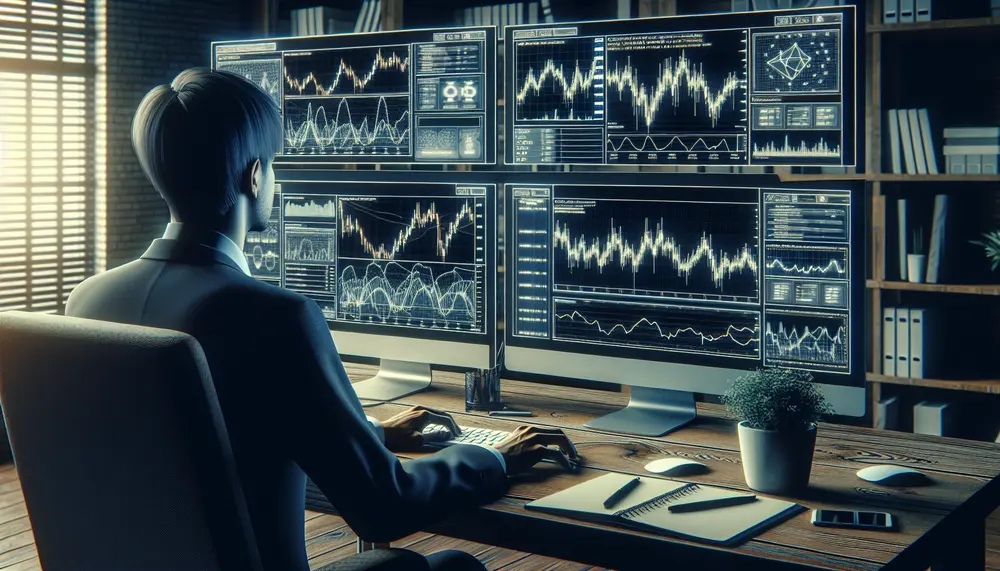

Option trading indicators are essential tools for analyzing market trends and making informed decisions, with different types serving various purposes such as trend identification and volatility measurement. While not foolproof, these indicators help traders predict market movements and refine their...

Option trading data is essential for informed decisions, encompassing market indicators like asset prices, volume, and volatility. Understanding these metrics helps traders identify trends and assess risk in the volatile cryptocurrency options market. Data analysis in option trading guides strategy development...