Posts on the Topic Crypto

Deribit is a leading crypto options trading platform specializing in Bitcoin and Ethereum derivatives, offering advanced tools, low-latency execution, deep liquidity, and user-friendly features for both novice and professional traders. Its robust technology, portfolio margining system, real-time analytics, and 24/7...

Crypto options trading calculators are essential tools that simplify complex calculations, predict potential profits or losses, and enhance trading strategies by allowing users to experiment with different scenarios using customizable features like time intervals and volatility options. These calculators serve...

Understanding crypto options volume is essential for traders as it indicates market activity, sentiment, and liquidity; platforms like CoinGlass offer analytics to aid in strategic decision-making. Additionally, open interest provides insights into market strength and potential trends, while the CME...

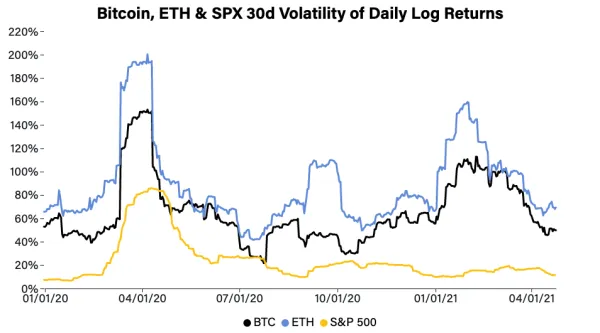

Crypto option trading allows traders to speculate on cryptocurrency price movements with limited risk, offering benefits like leverage and flexibility but also posing challenges such as market volatility and regulatory uncertainties. Technological advancements in blockchain, smart contracts, DeFi platforms, AI,...

Crypto options trading on decentralized exchanges (DEXs) offers enhanced security, privacy, and lower fees by leveraging blockchain technology for peer-to-peer transactions. Popular platforms like Hegic, Opyn, and Premia provide diverse features catering to different trading needs while ensuring transparency and...

Crypto options trading bots automate strategies to capitalize on market opportunities without constant monitoring, offering benefits like consistency, speed, data analysis, risk management, and 24/7 operation. Key features to look for include customizability, backtesting capabilities, robust security measures, an intuitive...

Crypto options market making involves providing liquidity by continuously quoting buy and sell prices for crypto options, helping ensure efficient trading. This practice benefits the market by increasing liquidity, reducing volatility, ensuring fair price discovery, and supporting institutional investors while...

Decentralized Exchanges (DEX) for crypto options trading offer several advantages over traditional centralized exchanges, including user control over funds, anonymity and privacy, transparency and fewer barriers to entry. These platforms represent the future of cryptocurrency trading by providing seamless user...