Vega

Vega

Introduction to Vega in Cryptocurrency Options Trading

If you are delving into the world of cryptocurrency options trading, one term that you will frequently encounter is Vega. Understanding Vega can broaden your trading toolkit and assist you in making more informed investment decisions. In the most basic terms, Vega refers to the sensitivity of an option's price to changes in the volatility of the underlying asset - in this case, a cryptocurrency like Bitcoin or Ethereum.

Breaking Down Vega

Every option price comprises a number of factors, and Vega essentially represents the amount an option's price will move given a 1% change in implied volatility. The emphasis here is on 'implied' volatility, which is a measure of the market's future expectation of price movement. When implied volatility goes up, option prices increase. This generally indicates a more significant market uncertainty. Conversely, when implied volatility goes down, the option prices decrease, pointing to a more stable market.

Vega in Practice

In practice, Vega assumes a significant role in options trading. A high Vega value implies that an options price is highly sensitive to volatility changes. For traders in the volatile cryptocurrency market, understanding how Vega works can offer insights into their risk exposure. For instance, an options trader holding options with a high Vega value needs to understand that a sudden surge in market volatility could significantly impact their portfolio's value.

Working with Vega

In order to effectively manage Vega, traders often use strategies such as Vega hedging. This involves taking positions in opposite directions in two different options to offset the Vega risk. For instance, if an options trader has purchased call options on Bitcoin with a high Vega, they may offset that risk by selling call options on Ethereum with a similarly high Vega.

Vega and Cryptocurrency Options

In the context of cryptocurrency options, Vega takes on elevated significance due to the incredibly high volatility of cryptocurrencies. Understanding Vega and its implications can be crucial in navigating the tumultuous waters of cryptocurrency trading. Always keep in mind, however, that while Vega offers valuable insights, it's just one of many factors to consider when making trading decisions.

In summary, Vega is a crucial concept in options trading, specifically in the volatile domain of cryptocurrencies. Mastering the knowledge of Vega and its impacts can help traders make more informed trading decisions, control risk, and potentially realise higher gains.

Blog Posts with the term: Vega

YouTube has become a key resource for learning option trading, offering channels that teach basics and advanced strategies to traders at all levels. Expert traders on YouTube also share tips on risk management, market research, and the importance of continuous...

This article simplifies the basics of crypto options trading, explaining key concepts like call and put options, strike prices, and expiration dates. It highlights the advantages such as leverage, risk management, flexibility, cost-effectiveness, and profitability in various market conditions while...

Robinhood's platform allows users to trade options without commission fees, offering a way to speculate on stock prices, hedge risks, or earn income. However, it involves higher risk than traditional trading and requires approval based on one’s experience and knowledge;...

Option trading is a complex field that involves contracts granting the right to buy or sell an asset, with call and put options being the two main types. Traders must understand market quotes, option values, strategies, risk management, and use...

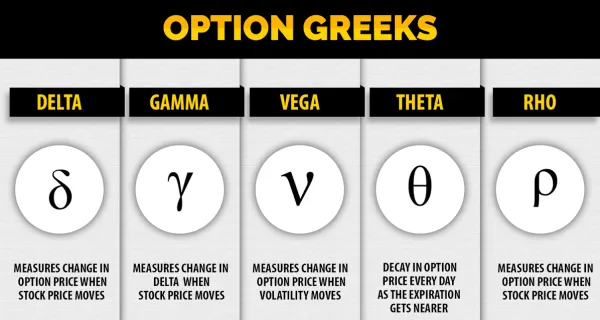

The Greeks are essential tools in the world of crypto options trading used to quantify risk and optimize returns. They measure different dimensions of risk, including sensitivity to the underlying price, acceleration of price changes, time decay, volatility, and interest...

Option trading on Angel One offers a range of financial instruments, including call and put options, with features like American and European settlement styles; the platform provides resources for beginners. Traders can choose from various types of options such as...

Option trading is a versatile investment strategy that involves buying and selling options, which are contracts granting the right to buy or sell an asset at a set price within a specific period. The article covers fundamental concepts like call...

Option trading profit percentage is a key indicator of return on investment, calculated by comparing the realized profit to the initial option premium while accounting for expenses like commissions and fees. Understanding options, calculating profits correctly, and considering factors such...

Bitcoin options on the CME provide a regulated and secure platform for traders to hedge positions or speculate on Bitcoin's price movements without directly owning it, offering benefits such as risk management, leverage, flexibility, cash settlement, and high liquidity. This...

Option trading and future trading are two distinct financial instruments for portfolio diversification, with options providing the right to trade without obligation and futures requiring a binding agreement. Options involve lower initial investment but limited risk exposure, while futures have...

Option trading online offers a versatile investment opportunity with strategies for various risk tolerances, involving contracts that grant the right to buy or sell assets at set prices within specific timeframes. Key concepts include understanding option types (calls and puts),...

Option trading involves contracts that give the buyer the right to buy or sell an asset at a set price before a certain date, without obligation. These flexible instruments cater to various strategies and require understanding of their mechanics for...

Option trading with a small investment of $50-$100 is feasible, focusing on leveraging capital to control more stock and potentially increase profits while managing risks. Understanding call and put options, obtaining broker approval, and prioritizing education are key steps for...

Fidelity offers a platform for trading Bitcoin options, which are financial derivatives allowing investors to buy or sell Bitcoin at a predetermined price before a specific date. This service includes robust security, comprehensive market data, and educational resources to aid...