What are the benefits of using cryptocurrencies as the underlying asset for options?

» Options Trading- Trading options with cryptocurrencies allows for 24/7 market access, enabling traders to respond to market movements at any time.

- Cryptocurrency volatility can lead to higher potential profits from options trading due to larger price swings.

- Using cryptocurrencies for options eliminates the need for traditional banking services, allowing for potentially lower transaction fees.

So I've been thinking, what's actually the upside of using cryptocurrencies for the underlying asset when you're dealing with options? Seen a lot of chatter about this but still not crystal clear on the advantages. Would be cool to get some insight on why crypto might be better compared to traditional assets in this space. Got some experience with options trading the usual suspects like stocks and commodities, but crypto's a different beast, right? What's the real benefit of diving into crypto options?

Absolutely, diving into crypto options does bring a fresh perspective to the table. The volatility in the crypto markets can amplify profit potentials, for sure. But then, that also comes with increased risk. It's like a double-edged sword. Liquidity can be patchy depending on the coin, though. Have you considered how the often lower liquidity impacts option pricing and the ability to execute strategies efficiently? It's fascinating how the decentralization aspect could shake things up, but what's your take on handling the regulatory uncertainties that seem to loom around crypto? And do you reckon the 24/7 market access makes a significant difference in the options world, given that it deviates from the typical trading hours of traditional markets?

You're hitting some key points about regulatory uncertainties and market hours. I wonder, though, how much the inherent transparency of blockchain impacts options trading with crypto. Since every transaction is recorded on a blockchain, do you think this could provide more security or clarity in trading, potentially reducing some types of fraud or manipulation?

Additionally, considering the rapid innovation in the crypto space, how do options traders keep up with the constantly evolving landscape of cryptocurrencies? Are there any tools or resources that are particularly useful in staying ahead, or is it more about staying adaptable and ready to learn quickly? Such a dynamic environment must require a pretty proactive approach to education and strategy adjustments, right? What strategies have you found effective in this regard?

- Are there any specific risk management techniques for trading crypto options? 3

- What strategies can I employ when trading DeFi crypto options? 11

- What are the most effective charting patterns for predicting price movements in options trading with cryptocurrencies? 4

- What is Rho and how does it impact options pricing? 9

- How do you manage to stay objective and not let bias affect your chart analysis? 5

- What timeframes are most relevant for options trading in the crypto market? 23

- How can chart analysis be used to determine the optimal time to enter or exit a position when trading options with cryptocurrencies? 3

- Can chart analysis alone be sufficient to make informed decisions when trading options with cryptocurrencies? 3

- How can I stay updated with the latest news and developments in the crypto options market? 2

- How can I use technical analysis to identify profitable options trading opportunities with cryptocurrencies? 4

- How can Fibonacci retracement and extension levels aid in predicting future price movements in the crypto options market? 241

- What is the concept of 'rolling' an option in crypto options trading, and when is it advantageous to use this strategy? 233

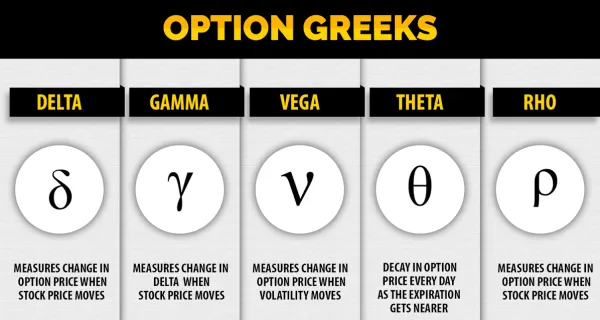

- How do the Greeks differ for call options vs put options? 226

- How can I implement 'collar' strategies in crypto options to protect my portfolio against significant losses? 226

- How does the 'covered call' strategy work in the context of crypto options trading, and when should it be used? 225

- How can technical indicators be used in options trading? 220

- How can I use 'spread' strategies like bull call spreads, bear put spreads, iron condors, and butterfly spreads in crypto options trading? 212

- Can you explain the terms 'call option' and 'put option' in the context of cryptocurrency? 211

- How can I integrate fundamental analysis with chart analysis to optimize my trading strategy in crypto options? 202

- Are there any specific books or resources you'd recommend for understanding options trading better? 201

Blog Posts | Current

A Beginner's Guide to Options Trading in Crypto

Introduction - A Beginner's Peek into the World of Crypto Options Trading The world of cryptocurrencies is not limited to buying...

Crypto Options 101: A Comprehensive Guide for Beginners

In an evolving digital world, cryptocurrency has become more than just a trend. It's a financial cusp heralding an era...

Liquidity in Bitcoin Options: Key Factors and Strategies

Introduction to Bitcoin Options and LiquidityTrading in the realm of cryptocurrencies has broadened considerably in recent years, with Bitcoin options...

Demystifying the Greeks in Crypto Options Trading

Introduction In the world of crypto options trading, understanding the Greeks is key to successfully managing risk and optimizing returns. Named...

Crypto Options Expiry: Timing, Impact, and Strategies

Trading with cryptocurrencies may seem challenging, with terms like the Crypto Options Expiry often throwing beginners off track. In this...

Mastering Chart Analysis: Tips and Tricks for Crypto Enthusiasts

Welcome to another value-packed article on Bitopex. Our goal remains to demystify the world of cryptocurrency trading, helping you navigate...

Bitopex Guide: Fibonacci Retracements in Crypto Chart Analysis

Introduction to Fibonacci Crypto Analysis Embarking on the journey to understand the world of cryptocurrencies and their market behavior can initially...

Ethereum's Flash Crashes: Causes, Consequences, and Coping Strategies

Introduction: Understanding Ethereum Flash Crashes A critical phase of investing in cryptocurrencies, such as Ethereum, involves understanding the sudden drops in...

Step-by-Step: Your First Crypto Options Trade

In the world of digital finance, the ability to navigate the terrain of cryptocurrency options trading can make a significant...

Welcoming You to Bitopex's New Blog and Forum: A Powerhouse of Crypto Options Knowledge and Engagement

Hello dear members, enthusiasts, and newcomers, We are elated to announce the launch of Bitopex's new blog and forum - an...