Can you explain the concept of 'straddle' and 'strangle' strategies in the context of crypto options and when to use each?

» Options Trading- A straddle is an options strategy involving the purchase of both a call and put option at the same strike price, typically used when expecting significant volatility in the underlying cryptocurrency but uncertain about the direction.

- A strangle involves buying both a call and put option with different strike prices, usually with the call strike higher and the put strike lower than the current price, suitable for high volatility situations with a more defined direction.

- Use a straddle when expecting dramatic price movement but unsure of direction; opt for a strangle when anticipating a significant move in a more certain direction and wishing to reduce upfront costs.

Hey guys, can someone break down the whole idea of 'straddle' and 'strangle' strategies when it comes to crypto options? I'm trying to figure out when it's best to use each of them. Any insights or examples would be greatly appreciated. Thanks!

Sure, I can help explain the straddle and strangle strategies in the context of crypto options.

The straddle strategy involves simultaneously buying both a call option and a put option with the same strike price and expiration date. This strategy is useful when there is an expectation of high volatility in the price of the underlying crypto asset. By buying both options, you're essentially taking a neutral position and are betting on a significant price movement in either direction.

On the other hand, the strangle strategy is similar to the straddle strategy but with different strike prices for the call and put options. The call option is typically purchased with a higher strike price, while the put option is purchased with a lower strike price. This strategy is useful when you anticipate a price breakout, but you're not sure in which direction it will occur.

Both strategies have their pros and cons, and it's important to consider factors like implied volatility, time decay, and the cost of the options before implementing them. Each strategy can be adjusted to meet your risk tolerance and market outlook.

I hope this gives you a better understanding of the straddle and strangle strategies. Let me know if you have any further questions or if you'd like to discuss specific examples. Happy trading!

If you expect a big price move in either direction, go for a straddle, buy a call and a put at the same price. Uncertain about the direction but still expect a massive swing? That's where strangle comes into play. Different strike prices for your call and put should do the trick. Just match strategies to your market predictions and risk tolerance. If you're still unsure, never hurts to do more research or ask a financial advisor.

Keep in mind, time decay and implied volatility will impact these strategies. Monitor the market closely, especially during peak volatility times to optimize your strategies. Accuracy in the anticipation of the price swing is key. Straddles need a bigger move than Strangles due to their higher cost but both can lead to unlimited profit with a capped risk. Consider that before investing.

Sounds like straddle and strangle are the Batman and Robin of crypto options. You just need to figure out who's driving the Batmobile on any given trade!

Consider this, straddles and strangles aren't for everyone. It's a wild ride with highs and lows. Make sure you strap in if you're going for it!

Sure, straddles and strangles seem tempting with their potential for big profits. However, consider the risk of the options expiring worthless if the price of the underlying asset doesn't move significantly. Think about the commission fees and transaction costs too. These strategies may sound advanced and potentially profitable on the surface, but they're not without their pitfalls and risks. Don't get too lost in the lingo and exciting potential, make sure you fully understand all the implications!

Honestly, I wouldn't touch these strategies with a ten-foot pole. Too unpredictable for me.

If you're asking me, more often than not, these strategies can be a rollercoaster. Make sure you strap in!

Do many of you trade with these strategies in similar markets, or is it mostly in crypto only? I'm trying to gauge how transferable these strategies are across different trading platforms.

Absolutely risky, but absolutely thrilling!

Always be prepared for unexpected market movements, especially if you're using these strategies. They can be a double-edged sword.

A gamble, at best.

I tell you what, straddles and strangles are like playing chess on a roller coaster. You're planning your next move while simultaneously trying not to lose your lunch. High-risk, high-reward, but definitely not for the faint of heart!

It's all about balance and knowing the market well.

Sounds like a wild ride to me.

When considering options like straddles and strangles, liquidity is another factor that shouldn't be overlooked. In less liquid markets, you might find it more challenging to execute these strategies effectively due to wider spreads between the bid and ask prices. This can affect the entry and exit points for your trade, potentially eroding the profitability. Always take a good look at the market's liquidity before diving in with these option strategies.

Dive into market sentiment too; it can seriously sway your straddle/strangle outcomes.

Make sure to stay updated with crypto news and events that could trigger volatility, which is prime for straddles and strangles.

- Are there any platforms that provide educational resources or tutorials for options trading? 8

- Which chart timeframes are most effective for conducting analysis when trading options with cryptocurrencies? 7

- What are the key considerations when using chart analysis to determine the appropriate strike price for options trading with cryptocurrencies? 4

- What time frames do you find most reliable for chart analysis in intraday trading? 6

- Are crypto options regulated by any authorities? 3

- Can you recommend any online communities or forums for discussing option trading with cryptocurrencies? 3

- How does technical chart analysis differ in option trading with cryptocurrencies compared to other traditional assets? 5

- How can chart analysis be used to optimize option trading with cryptocurrencies? 4

- Are there any specific risk management techniques for trading crypto options? 3

- What strategies can I employ when trading DeFi crypto options? 11

- How can Fibonacci retracement and extension levels aid in predicting future price movements in the crypto options market? 241

- What is the concept of 'rolling' an option in crypto options trading, and when is it advantageous to use this strategy? 234

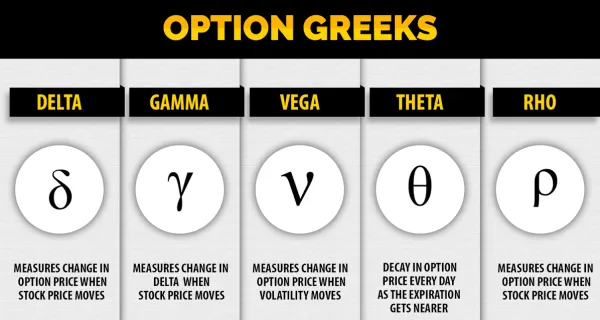

- How do the Greeks differ for call options vs put options? 227

- How can I implement 'collar' strategies in crypto options to protect my portfolio against significant losses? 226

- How does the 'covered call' strategy work in the context of crypto options trading, and when should it be used? 225

- How can technical indicators be used in options trading? 220

- How can I use 'spread' strategies like bull call spreads, bear put spreads, iron condors, and butterfly spreads in crypto options trading? 213

- Can you explain the terms 'call option' and 'put option' in the context of cryptocurrency? 211

- How can I integrate fundamental analysis with chart analysis to optimize my trading strategy in crypto options? 203

- What are some advanced strategies for trading call options in the crypto market? 202

Blog Posts | Current

Crypto Options 101: A Comprehensive Guide for Beginners

In an evolving digital world, cryptocurrency has become more than just a trend. It's a financial cusp heralding an era...

Demystifying the Greeks in Crypto Options Trading

Introduction In the world of crypto options trading, understanding the Greeks is key to successfully managing risk and optimizing returns. Named...

Step-by-Step: Your First Crypto Options Trade

In the world of digital finance, the ability to navigate the terrain of cryptocurrency options trading can make a significant...

A Beginner's Guide to Options Trading in Crypto

Introduction - A Beginner's Peek into the World of Crypto Options Trading The world of cryptocurrencies is not limited to buying...

Bitopex Guide: Fibonacci Retracements in Crypto Chart Analysis

Introduction to Fibonacci Crypto Analysis Embarking on the journey to understand the world of cryptocurrencies and their market behavior can initially...

Liquidity in Bitcoin Options: Key Factors and Strategies

Introduction to Bitcoin Options and LiquidityTrading in the realm of cryptocurrencies has broadened considerably in recent years, with Bitcoin options...

Ethereum's Flash Crashes: Causes, Consequences, and Coping Strategies

Introduction: Understanding Ethereum Flash Crashes A critical phase of investing in cryptocurrencies, such as Ethereum, involves understanding the sudden drops in...

Mastering Chart Analysis: Tips and Tricks for Crypto Enthusiasts

Welcome to another value-packed article on Bitopex. Our goal remains to demystify the world of cryptocurrency trading, helping you navigate...

Welcoming You to Bitopex's New Blog and Forum: A Powerhouse of Crypto Options Knowledge and Engagement

Hello dear members, enthusiasts, and newcomers, We are elated to announce the launch of Bitopex's new blog and forum - an...

Crypto Options Expiry: Timing, Impact, and Strategies

Trading with cryptocurrencies may seem challenging, with terms like the Crypto Options Expiry often throwing beginners off track. In this...