Vega

Vega

Introduction to Vega in Cryptocurrency Options Trading

If you are delving into the world of cryptocurrency options trading, one term that you will frequently encounter is Vega. Understanding Vega can broaden your trading toolkit and assist you in making more informed investment decisions. In the most basic terms, Vega refers to the sensitivity of an option's price to changes in the volatility of the underlying asset - in this case, a cryptocurrency like Bitcoin or Ethereum.

Breaking Down Vega

Every option price comprises a number of factors, and Vega essentially represents the amount an option's price will move given a 1% change in implied volatility. The emphasis here is on 'implied' volatility, which is a measure of the market's future expectation of price movement. When implied volatility goes up, option prices increase. This generally indicates a more significant market uncertainty. Conversely, when implied volatility goes down, the option prices decrease, pointing to a more stable market.

Vega in Practice

In practice, Vega assumes a significant role in options trading. A high Vega value implies that an options price is highly sensitive to volatility changes. For traders in the volatile cryptocurrency market, understanding how Vega works can offer insights into their risk exposure. For instance, an options trader holding options with a high Vega value needs to understand that a sudden surge in market volatility could significantly impact their portfolio's value.

Working with Vega

In order to effectively manage Vega, traders often use strategies such as Vega hedging. This involves taking positions in opposite directions in two different options to offset the Vega risk. For instance, if an options trader has purchased call options on Bitcoin with a high Vega, they may offset that risk by selling call options on Ethereum with a similarly high Vega.

Vega and Cryptocurrency Options

In the context of cryptocurrency options, Vega takes on elevated significance due to the incredibly high volatility of cryptocurrencies. Understanding Vega and its implications can be crucial in navigating the tumultuous waters of cryptocurrency trading. Always keep in mind, however, that while Vega offers valuable insights, it's just one of many factors to consider when making trading decisions.

In summary, Vega is a crucial concept in options trading, specifically in the volatile domain of cryptocurrencies. Mastering the knowledge of Vega and its impacts can help traders make more informed trading decisions, control risk, and potentially realise higher gains.

Blog Posts with the term: Vega

This article simplifies the basics of crypto options trading, explaining key concepts like call and put options, strike prices, and expiration dates. It highlights the advantages such as leverage, risk management, flexibility, cost-effectiveness, and profitability in various market conditions while...

YouTube has become a key resource for learning option trading, offering channels that teach basics and advanced strategies to traders at all levels. Expert traders on YouTube also share tips on risk management, market research, and the importance of continuous...

Robinhood's platform allows users to trade options without commission fees, offering a way to speculate on stock prices, hedge risks, or earn income. However, it involves higher risk than traditional trading and requires approval based on one’s experience and knowledge;...

Option trading is a complex field that involves contracts granting the right to buy or sell an asset, with call and put options being the two main types. Traders must understand market quotes, option values, strategies, risk management, and use...

Deribit is a leading platform for Bitcoin options trading, offering deep liquidity, advanced analytics, and robust tools like the Option Wizard to cater to both novice and expert traders. Its focus on security, innovation, and user-friendly features makes it a...

Option trading on Angel One offers a range of financial instruments, including call and put options, with features like American and European settlement styles; the platform provides resources for beginners. Traders can choose from various types of options such as...

Bybit’s crypto options platform offers a user-friendly, feature-rich environment for both beginners and pros to trade European-style contracts with robust liquidity. Setting up an account is straightforward, and the intuitive interface makes navigating option chains, placing trades, and managing risk...

Bitcoin options on the CME provide a regulated and secure platform for traders to hedge positions or speculate on Bitcoin's price movements without directly owning it, offering benefits such as risk management, leverage, flexibility, cash settlement, and high liquidity. This...

Deribit is a leading crypto options trading platform specializing in Bitcoin and Ethereum derivatives, offering advanced tools, low-latency execution, deep liquidity, and user-friendly features for both novice and professional traders. Its robust technology, portfolio margining system, real-time analytics, and 24/7...

Option trading profit percentage is a key indicator of return on investment, calculated by comparing the realized profit to the initial option premium while accounting for expenses like commissions and fees. Understanding options, calculating profits correctly, and considering factors such...

Option trading is a versatile investment strategy that involves buying and selling options, which are contracts granting the right to buy or sell an asset at a set price within a specific period. The article covers fundamental concepts like call...

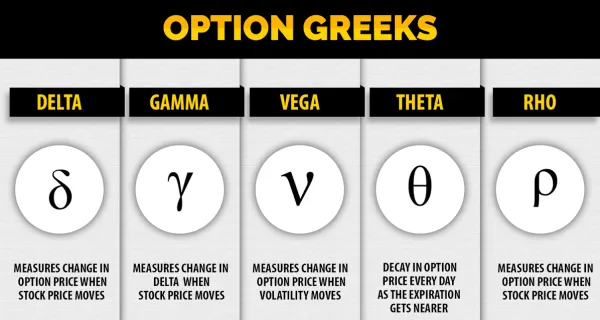

The Greeks are essential tools in the world of crypto options trading used to quantify risk and optimize returns. They measure different dimensions of risk, including sensitivity to the underlying price, acceleration of price changes, time decay, volatility, and interest...

Coinbase is making Bitcoin options trading accessible and user-friendly for both retail and professional traders by integrating it into its regulated platform with intuitive tools, real-time analytics, and clear risk management features. This streamlined approach allows users to hedge or...

Option trading on Fidelity offers investors a way to diversify their portfolios, hedge against market volatility, and speculate on stock movements with tools for both beginners and experienced traders. The platform provides educational resources, analytic tools for risk assessment, and...