Relative Strength Index

Relative Strength Index

Understanding the Relative Strength Index in Cryptocurrency Option Trading

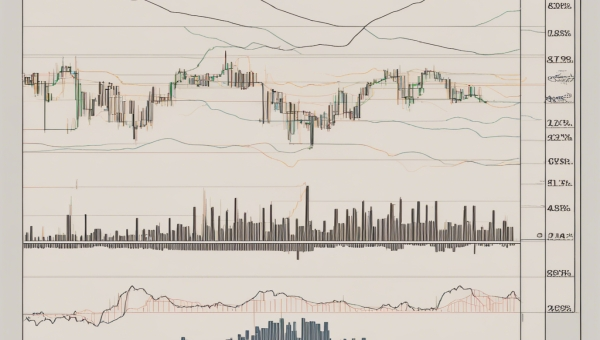

If you are new to the world of option trading with cryptocurrencies, you may have come across the term Relative Strength Index or RSI. This is a crucial tool used by traders to assess the performance of digital assets. In simple terms, the RSI is a momentum oscillator which measures the speed and change of price movements of a cryptocurrency.

How Does the Relative Strength Index Work?

The Relative Strength Index is calculated on a scale from 0 to 100. Usually, a cryptocurrency might be considered overbought (and potentially overpriced) when the RSI is above 70. This could mean that the price might soon correct (i.e drop). Inversely, a cryptocurrency is often viewed as oversold (and potentially underpriced) if its RSI is below 30, suggesting that its price may rise in the future. It's important to note that these are guidelines and not hard and fast rules.

Why Is the Relative Strength Index Important in Option Trading?

When trading options with cryptocurrencies, investors need to predict future price movements. Using the RSI can help traders have a more informed view of whether a cryptocurrency is currently being overbought or oversold. This information can guide decision-making when entering or exiting trades. However, it's essential to remember that RSI should not be the only tool used for making decisions but is most effective when used in conjunction with other trading tools and strategies.

How Is the Relative Strength Index Calculated?

The calculation of the RSI involves a somewhat complex mathematical formula which takes into account the average gain and average loss over a specific period of time, usually 14 periods. The first calculation of the average loss and gain is simple and then it is calculated in a smoothed version for the remaining periods. This final calculation helps in assessing the cryptocurrency's strength or weakness. But traders need not worry about the math - most charting tools automatically calculate and display the RSI.

Conclusion

In essence, the Relative Strength Index is an essential tool in option trading with cryptocurrencies. It provides valuable insights into market dynamics and can significantly aid in making informed trading decisions. But remember, no trading tool can guarantee absolute success; using it alongside other tools and market analysis techniques can increase the likelihood of favourable outcomes.

"Blog Posts with the term: Relative Strength Index

Option trading can enhance returns, but mastering entry and exit strategies is crucial for success. This article covers key indicators like moving averages, RSI, Bollinger Bands, MACD, and volume to help traders make informed decisions on when to enter or...

Option trading is a complex field that involves contracts granting the right to buy or sell an asset, with call and put options being the two main types. Traders must understand market quotes, option values, strategies, risk management, and use...

Coinbase has introduced crypto options trading, allowing users to speculate on future cryptocurrency prices with strategies like covered calls; the platform is user-friendly and secure, offering educational resources for beginners....

The article explains the differences between bitcoin options and futures, highlighting that while both are used for hedging and speculation in cryptocurrency markets, they differ significantly in terms of contractual obligations, risk exposure, profit potential, upfront costs, and market liquidity....

Bitcoin options are financial derivatives allowing the holder to buy or sell bitcoins at a predetermined price on a specific date, used by traders to hedge against volatility or speculate on future prices. Historical data in bitcoin options trading is...

Bitcoin's value is heavily influenced by human psychology, with market sentiment, fear of missing out (FOMO), greed, and emotional factors playing a significant role. Understanding these factors is crucial for anyone engaging in Bitcoin trading. Market sentiment, which refers to...

This article introduces chart analysis techniques for cryptocurrency trading. It covers the basics of reading candlestick charts, the pros and cons of different analysis techniques, and the importance of recognizing chart patterns and understanding moving averages. The article aims to...

Option trading online offers a versatile investment opportunity with strategies for various risk tolerances, involving contracts that grant the right to buy or sell assets at set prices within specific timeframes. Key concepts include understanding option types (calls and puts),...

Option trading offers two distinct styles: intraday and delivery. Intraday involves quick trades within a single day using leverage, aiming for short-term profits but with high risk due to market volatility; whereas delivery is long-term, seeking asset appreciation and dividends...

Fidelity offers a platform for trading Bitcoin options, which are financial derivatives allowing investors to buy or sell Bitcoin at a predetermined price before a specific date. This service includes robust security, comprehensive market data, and educational resources to aid...

Ethereum contract options are financial derivatives that allow traders to speculate on Ethereum's price movements without owning the asset, offering potential high returns with low investment and portfolio diversification. This guide explains their types (call and put options), key terms...

Option trading quantity, or position size, is essential for managing risk and aligning trades with a trader's goals and tolerance in cryptocurrency markets. Factors like market volatility, account size, experience, risk tolerance, investment goals, time horizon, and liquidity must be...

Weekly expiry options, expiring every Friday, offer traders frequent opportunities to capitalize on short-term market movements with lower premiums and flexibility but come with challenges like rapid time decay and increased volatility. Effective strategies for trading these options include the...

This article provides an introduction to the Moving Average Convergence Divergence (MACD) indicator and its relevance in predicting price swings in cryptocurrencies. The MACD is a trend-following momentum indicator that can help traders determine when to buy or sell based...