Long Strangle

Long Strangle

In the captivating world of option trading with cryptocurrencies, there are a plethora of strategies that traders can employ to leverage their investments. One such high-risk yet high-reward strategy is the Long Strangle. Understanding this term and its implications can significantly boost your trading outcomes.

Understanding the 'Long Strangle'

A Long Strangle is an investment strategy used in option trading including cryptocurrencies. It's a position that a trader takes when they believe there will be a significant price move in the underlying asset (here cryptocurrency), but they are unsure about the direction of that move.

How a 'Long Strangle' Works?

In the Long Strangle strategy, a trader buys an out-of-the-money call option and an out-of-the-money put option on the same underlying asset and expiration date. The call option is betting on the value of the asset going up, while the put option is betting on it going down. The options are "out-of-the-money" when the strike price — the price at which the option can be exercised — is different from the current market price of the asset.

Benefits and Risks of a 'Long Strangle'

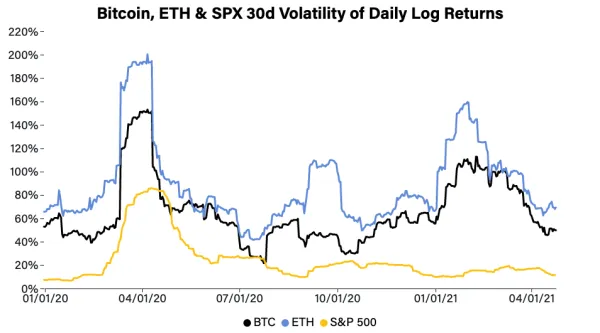

A Long Strangle benefits when the price of the underlying cryptocurrency moves significantly. Since you are holding both a call and put option, whether the asset price rises or falls does not matter, as long as the move is substantial. Therefore, it's a good strategy for periods of expected high volatility.

However, this strategy also has its risks. If the price of the cryptocurrency does not move much or stays within a small range, the options will expire worthless, leading to a loss of the initial investment. Hence, it’s important to use this strategy cautiously and after thorough market analysis.

'Long Strangle' in Cryptocurrency Trading

In the volatile cryptocurrency market, the Long Strangle strategy can potentially yield substantial returns. The significant price swings common in cryptocurrency markets make them a suitable environment for this kind of strategy. However, just like with all trading strategies, it's essential to manage risk appropriately and not invest more than what you are willing to lose.

Blog Posts with the term: Long Strangle

Crypto options trading allows traders to profit from cryptocurrency volatility using strategies like covered calls, protective puts, and collars to manage risk and enhance returns. Understanding call and put options is essential for implementing these strategies effectively in the crypto...

Bitcoin option strategies are crucial for managing risks and optimizing returns in the volatile cryptocurrency market, offering flexibility through contracts that allow buying or selling Bitcoin at predetermined prices. Key strategies include Covered Call for income generation, Protective Put as...

Option trading involves contracts that allow buying or selling an asset at a set price before expiration, with strategies for profit relying on predicting the asset's price movement and using leverage wisely. Option buyers use various strategies to maximize gains...