Table of Contents:

Crypto Options Strategies: Mastering the Art of Volatility

Introduction

Crypto options are rapidly gaining traction among crypto enthusiasts, traders, and investors alike due to their potential for high returns and flexibility. One of the most appealing aspects of trading options is the ability to devise a myriad of strategies. This article will delve into various crypto options strategies designed to help you manage risk and potentially enhance profitability.

Long Call: Betting on the Bull

When a trader anticipates a significant increase in the price of a cryptocurrency, they might opt for a long call strategy. This involves buying a call option at a specific strike price. Should the market price surge beyond the strike price before or on the expiration date, the trader can buy the crypto at the strike price and then sell at the market price, realizing a profit.

Pros and Cons of Crypto Options Strategies

| Strategy | Pros | Cons |

|---|---|---|

| Long Call | Profit potential is theoretically unlimited. If the price of the underlying asset increases, the trader's profit increases. | Risk of the option expiring worthless if the price of the underlying decreases. |

| Short Call | If the price decreases or remains the same, the option expires worthless and the trader keeps the premium. | Unlimited risk. If the price of the underlying increases, the loss increases. |

| Long Put | Profit increases as the price of the underlying decreases. Limited risk. | If the price of the underlying increases or remains the same, the risk is that the option expires worthless. |

| Short Put | If the price increases or remains the same, the option expires worthless and the trader keeps the premium. | Risk of substantial losses if the price of the underlying decreases. |

| Straddle | Profitable if there is a large move in either direction. | If the price of the underlying remains the same, both options expire worthless. |

| Strangle | Can be profitable if there is a large move in either direction. | If the price of the underlying remains within a certain range, both options expire worthless. |

Long Put: Riding the Bear Market

Conversely, if a trader predicts a drop in the cryptocurrency's price, they could consider a long put strategy. This entails buying a put option. If the market price falls below the strike price before expiration, the trader can sell the crypto at the strike price and then buy back at the lower market price, securing a profit.

Covered Call: For the Moderate Bulls

A covered call strategy involves owning the underlying cryptocurrency and selling a call option on it. This approach is designed to generate income through the premiums collected from selling the call option. However, it limits profit potential if the cryptocurrency's price rises significantly beyond the strike price.

Protective Put: Insuring Your Investments

In a protective put strategy, a trader owns the underlying cryptocurrency and buys a put option for it. This strategy is akin to buying insurance for the cryptocurrency holdings. If the price falls, the losses are mitigated by gains from the put option.

Straddles and Strangles: Betting on Volatility

Both straddles and strangles are advanced strategies that traders employ when they expect significant price movement but are unsure of the direction.

A long straddle involves buying a call and a put option with the same strike price and expiration date. No matter which way the market moves, if it moves enough, the trader stands to profit.

A long strangle, on the other hand, involves buying a call and a put option, but the call has a higher strike price than the put. This strategy profits when there's a significant price movement in either direction.

Conclusion

The world of crypto options trading is rich with strategic possibilities. Whether you're bullish, bearish, or expect high volatility, there's a strategy that can align with your market outlook. By understanding and employing these strategies, you can better navigate the unpredictable waters of the cryptocurrency market.

At Bitopex, we offer a diverse range of crypto derivatives, including options. Join our platform to explore the potential of crypto options trading today.

Remember, while crypto options offer the potential for high returns, they can also entail significant risk. Always conduct thorough research and consider seeking advice from financial advisors before diving into crypto options trading.

YouTube - eine der größten Plattformen zum Teilen und Genießen von Videos

YouTube ist eine der größten Video-Sharing-Plattformen im Internet. Es bietet eine Fülle an Videos, die jedermann anschauen und mögen kann. Es ist auch kostenlos, sicher und einfach zu bedienen.

YouTube ermöglicht Benutzern, Videos unter verschiedenen Kategorien zu durchsuchen und sie nach Interessengebieten zu sortieren. Es gibt eine große Auswahl an Videos, wie zum Beispiel Comedy-Clips, Musikvideos, Tutorials, Nachrichten, Sport, Filme und mehr. Die Plattform ist sehr benutzerfreundlich, so dass Benutzer Videos schnell und einfach finden und dazu interessante Kommentare machen und beliebte Videos mit anderen teilen können.

YouTube bietet auch eine Möglichkeit, qualitativ hochwertige Inhalte zu erstellen und zu verbreiten. Benutzer haben die Möglichkeit, ihre Videos zu bearbeiten und sie auf verschiedenen Geräten anzusehen. Es gibt auch zahlreiche Tools, mit denen Videos bearbeitet werden können, woran Benutzer ihrer Kreativität freien Lauf lassen können.

YouTube ist eine großartige Plattform, auf der man Videos teilen und genießen kann. Mit einer riesigen Auswahl an Videos, die jeden Geschmack und jede Interessengebiet abdeckt, bietet es ein unvergleichliches Videoerlebnis. Egal, ob man Comedy-Clips, Nachrichten oder Sportvideos anschauen möchte, auf YouTube ist für jeden etwas dabei.

A Comprehensive Guide on Crypto Options Strategies

What are Crypto Options?

Crypto options are financial instruments that give the holder the right but not the obligation to buy or sell a specific cryptocurrency at a predetermined price on or before a specified date.

What is Volatility in Crypto Options?

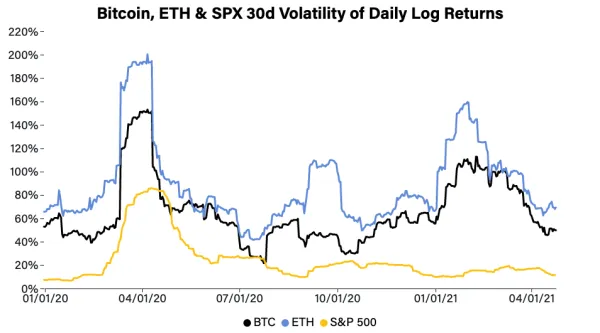

Volatility in crypto options refers to the degree of variation of a trading price series over time. It is used by traders to gauge the risk and potential for large, unexpected moves in the market.

Where can you trade Crypto Options?

Crypto options can be traded on specialized cryptocurrency exchanges that offer options trading, such as Deribit or LedgerX.

How to Master the Art of Volatility in Crypto Options?

To master the art of volatility in crypto options, one needs to understand the basics of options trading, keep abreast of market news, and use technical analysis to identify patterns and market trends. It also requires discipline and sound risk management strategies.

What strategies are used for trading Crypto Options?

Popular strategies for trading Crypto Options include straddles, strangles, call spreads, and put spreads. These options strategies can help traders make the most of market volatility and limit their risk of loss.