Trading System

Trading System

Understanding a Trading System

A Trading System is a set of precise, rule-based procedures for trading securities, forex, cryptocurrencies and other financial instruments. The aim is to generate returns by identifying and exploiting advantageous trading opportunities.

Cornerstones of a Trading System

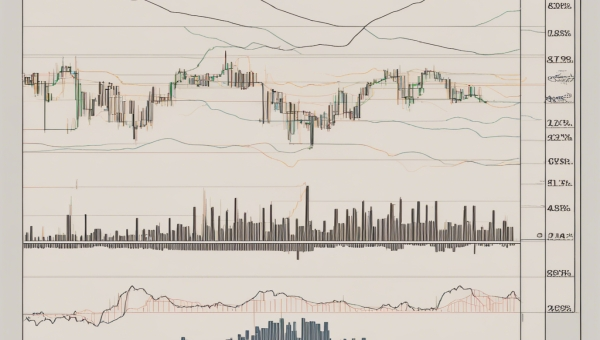

The main components of a Trading System includes a model for market analysis, a set of rules for trade entries and exits, criteria for risk management, and a platform or medium for executing trades.

Trading Systems and Cryptocurrencies

In the realm of option trading with cryptocurrencies, a Trading System becomes immensely valuable. It provides a structured, systematic approach to navigate the highly volatile and unpredictable cryptocurrency markets. Algorithms can identify patterns and trends that are usually too complex to manually decipher.

Types of Trading Systems

There are various types of Trading Systems - ranging from simple to complex, manual to fully automated. Some rely on technical analysis, while others focus on macroeconomic trends or use machine learning algorithms.

Advantages of a Trading System

Implementing a Trading System can eliminate emotional bias, improve efficiency, and enhance predictability of trade outcomes. Especially in option trading with cryptocurrencies where market conditions can change rapidly and unpredictably, this systematic approach can be a game-changer.

Choosing the Right Trading System

Choosing the right Trading System for option trading with cryptocurrencies depends on various factors like your investment goals, risk tolerance, market understanding, and technical skills. A well-chosen system can aid in realizing potential profits and mitigate losses.

Blog Posts with the term: Trading System

Option trading is a complex field that involves contracts granting the right to buy or sell an asset, with call and put options being the two main types. Traders must understand market quotes, option values, strategies, risk management, and use...

The article explains the basics of option trading with Python, highlighting options as financial instruments and Python's suitability due to its simplicity and powerful libraries. It emphasizes learning Python programming, utilizing finance-specific libraries like NumPy, pandas, and matplotlib, automating tasks...

Option trading online offers a versatile investment opportunity with strategies for various risk tolerances, involving contracts that grant the right to buy or sell assets at set prices within specific timeframes. Key concepts include understanding option types (calls and puts),...

Option trading offers two distinct styles: intraday and delivery. Intraday involves quick trades within a single day using leverage, aiming for short-term profits but with high risk due to market volatility; whereas delivery is long-term, seeking asset appreciation and dividends...

Daily expiry in Bitcoin options trading offers traders precision and flexibility to capitalize on short-term price movements, with lower premiums but higher timing demands. While it provides opportunities for quick profits through frequent settlements, its fast-paced nature requires disciplined strategies...

Option trading in Canada allows investors to buy and sell options contracts for various purposes, including income generation, hedging, or speculation. It's important for traders to understand the basics of option types, market positions, regulatory environment on exchanges like TSX...

The article discusses the fundamentals and strategic integration of option trading and future trading, highlighting their differences in commitment levels and risk obligations while emphasizing their common use of leverage. It explores strategies for combining both types of trades to...

This article provides an introduction to the Moving Average Convergence Divergence (MACD) indicator and its relevance in predicting price swings in cryptocurrencies. The MACD is a trend-following momentum indicator that can help traders determine when to buy or sell based...

Option trading in the USA has grown significantly due to technological advancements, increased market participation, and innovative financial products, offering benefits like leverage, risk management, income generation, flexibility, cost efficiency, and profit potential. The market is regulated by SEC and...

Option trading data is essential for informed decisions, encompassing market indicators like asset prices, volume, and volatility. Understanding these metrics helps traders identify trends and assess risk in the volatile cryptocurrency options market. Data analysis in option trading guides strategy development...

Option trading is a flexible investment strategy that allows traders to buy or sell an asset at a predetermined price, offering benefits like leverage and hedging but also carrying risks such as time decay and market volatility. It contrasts with...

Option trading holidays, which usually coincide with NYSE holidays, are critical for traders to monitor due to their impact on market liquidity and option pricing strategies. These days can lead to reduced trading activity and wider bid-ask spreads, requiring adjustments...

Option trading is a complex and high-leverage market activity that requires understanding of market conditions, risks, and continuous learning to navigate successfully. Education plays a critical role in achieving success by providing traders with the knowledge needed for informed decision-making...

The article provides an introduction to real-time Bitcoin options trading, explaining how these financial derivatives allow traders to buy or sell Bitcoin at a predetermined price within a specific timeframe. It highlights the importance of understanding market dynamics and using...