Rally

Rally

Understanding the 'Rally' in Option Trading with Cryptocurrencies

When you dive into the sphere of option trading with cryptocurrencies, you will come across diverse trading terminologies. One such term, frequently used, is a 'Rally'. But what does this term signify?

The Definition of 'Rally'

In its simplest form, a 'Rally' refers to a fast increase in the price of a cryptocurrency over a short period. This surge in price creates a bullish market scenario where traders expect prices to rise continually. While rallies can happen in any market, they’re especially significant in the volatile world of cryptocurrencies where price swings can be dramatic.

Identifying a 'Rally'

Being able to spot a 'rally' in its early stages can play a game-changing role in your trading strategy. Usually, a rally begins after a period of flat or falling prices and is backed by a higher trading volume. Traders should watch out for these signs and purchase options betting on a price rise.

'Rally' and Options Trading

In options trading with cryptocurrencies, a 'rally' can be a golden opportunity. If traders are able to anticipate a rally correctly, they could purchase call options, which increase in value as the cryptocurrency's price surges. However, it's important to remember that options trading comes with the risk of losing your entire investment if the prediction doesn't play out as expected.

Conclusion

Understanding the concept of a 'rally' is essential in the realm of cryptocurrency options trading. Being accurate in predicting a rally could mean a significant boost in trading returns. But remember, as in any form of trading, it's crucial to manage risk effectively and never invest more than you're willing to lose.

Blog Posts with the term: Rally

Crypto options trading allows speculation on future cryptocurrency prices without owning the asset, offering high returns with small investments but also significant risks. This guide covers essential concepts like call and put options, setting up a trading account, and basic...

The article discusses the concept of Crypto Options Expiry in cryptocurrency trading. It explains what it is, how it affects trading decisions and market volatility, and provides strategies for traders to maximize profits and manage risks. Understanding and effectively utilizing...

Bitcoin options trading provides a strategic approach to cryptocurrency investment, allowing traders the right to buy or sell Bitcoin at a predetermined price before expiration without owning the actual asset. Understanding calls and puts is crucial for navigating market volatility...

The article explains the differences between bitcoin options and futures, highlighting that while both are used for hedging and speculation in cryptocurrency markets, they differ significantly in terms of contractual obligations, risk exposure, profit potential, upfront costs, and market liquidity....

The article provides a beginner's guide to understanding the differences between cryptocurrency and options trading, highlighting that crypto trading involves buying and selling digital assets with high volatility while options trading allows speculation on asset prices through contracts without owning...

Bybit’s crypto options platform offers a user-friendly, feature-rich environment for both beginners and pros to trade European-style contracts with robust liquidity. Setting up an account is straightforward, and the intuitive interface makes navigating option chains, placing trades, and managing risk...

Option trading is a financial activity where contracts, known as options, give buyers the right but not the obligation to buy or sell an asset at a set price before a certain date. These come in two types: call options...

In this article, the author explores the importance of understanding Bitcoin chart patterns in order to predict future price movements and make informed trading decisions. They discuss common chart patterns such as the Head and Shoulders, Double Top and Double...

The article explains the fundamentals and strategies of Bitcoin options trading, detailing types of options like calls and puts, key components such as strategic planning, market analysis, risk management, leverage use, and performance monitoring. It emphasizes understanding market trends through...

Option trading involves contracts that give buyers the right to buy or sell an asset at a set price before expiration, with calls for buying and puts for selling. These options can be used for hedging, speculation, or leveraging positions...

Option trading on expiry day involves heightened volatility and the potential for significant gains or losses as traders make final decisions regarding their positions. It's a critical time with specific rules, timelines, and phenomena like 'pinning' affecting market behavior; understanding...

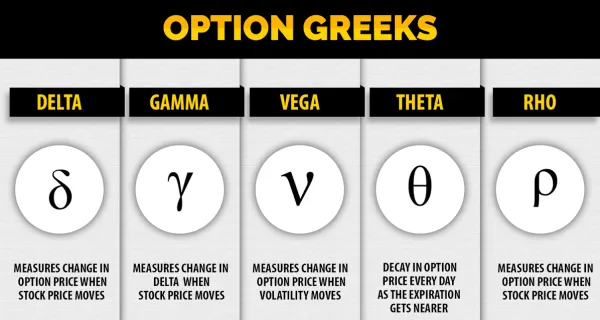

The Greeks are essential tools in the world of crypto options trading used to quantify risk and optimize returns. They measure different dimensions of risk, including sensitivity to the underlying price, acceleration of price changes, time decay, volatility, and interest...

Option trading charges are fees incurred when buying or selling options, including commission, regulatory, exchange, clearing, and miscellaneous fees. Understanding these costs is crucial for traders to manage finances effectively and strategize to minimize expenses while maximizing potential profits....

Ethereum Options Expiry is a critical concept in cryptocurrency trading, referring to the date and time when Ethereum options contracts expire, impacting market volatility, price discovery, risk management, and liquidity. Understanding these expiries helps traders anticipate market movements and adjust...