Price Change

Price Change

Understanding 'Price Change' in Cryptocurrency Options Trading

When it comes to Option trading with cryptocurrencies, a fundamental concept to understand is the term 'Price Change'. This term refers to the difference in value or price of a specific cryptocurrency within a given time frame. The rate at which the price of a cryptocurrency increases or decreases within a particular set of returns is known as the 'Price Change'.

Importance of 'Price Change'

Understanding 'Price Change' is crucial for several reasons. Primarily, it is an indispensable tool/indicator for traders, used to assess the volatility or stability of cryptocurrencies, which are essential factors in making stellar trading decisions. An asset's value can either go up (increase) or down (decrease); this fluctuation in price is what is referred to as 'Price Change'.

How 'Price Change' Influences Trading Decisions

By tracking the 'Price Change' of cryptocurrencies, traders can forecast potential future moves and strategize accordingly. For instance, if a trader observes a positive price change trend with a particular cryptocurrency, they might consider buying options for it in anticipation of further price increases. On the other hand, a negative 'Price Change' trend could prompt traders to sell or avoid buying options of a specific cryptocurrency.

Measuring 'Price Change'

In the dynamic field of cryptocurrency options trading, 'Price Change' is often expressed as a percentage. This is a more expressive and normalized way to represent value changes. For instance, instead of stating the price change of a cryptocurrency as an absolute difference in numerical value, stating it in percentage provides better insight into the proportion of the price change relative to the initial price.

Interpreting 'Price Change'

Interpreting 'Price Change' is as straightforward as understanding its definition. A positive percentage implies that the value of the cryptocurrency is rising, indicating potentially good market conditions for buying or holding the cryptocurrency. On the other hand, a negative percentage indicates a drop in the asset's value: it could either be an entry point for buyers looking for a cheap option or a signal for sellers/holders to exit the market to cut losses or lock in profits.

Conclusion

The concept of 'Price Change' is a core foundation in the landscape of cryptocurrency options trading. Whether a novice or a seasoned trader, understanding this fundamental term is vital to accurate market analysis, sound trading decisions, and consequently, potential profitability in the ever-volatile cryptocurrency market.

Blog Posts with the term: Price Change

This article simplifies the basics of crypto options trading, explaining key concepts like call and put options, strike prices, and expiration dates. It highlights the advantages such as leverage, risk management, flexibility, cost-effectiveness, and profitability in various market conditions while...

A Bitcoin options trading strategy helps traders manage risk and capitalize on market movements by using contracts that offer the right, but not obligation, to buy or sell at a set price. Utilizing tools like strategy builders allows for precise...

The article explains the differences between bitcoin options and futures, highlighting that while both are used for hedging and speculation in cryptocurrency markets, they differ significantly in terms of contractual obligations, risk exposure, profit potential, upfront costs, and market liquidity....

Deribit is a leading platform for Bitcoin options trading, offering deep liquidity, advanced analytics, and robust tools like the Option Wizard to cater to both novice and expert traders. Its focus on security, innovation, and user-friendly features makes it a...

Bitcoin options expiry in India involves both daily and monthly cycles, impacting market dynamics as traders adjust positions near expiration times. Aligning these expiries with market closure at 5:30 PM IST ensures smooth settlements, influencing trading strategies by affecting volatility...

Bitcoin options expiry is a critical concept in cryptocurrency trading, referring to the date when an options contract becomes invalid and must be exercised or allowed to expire worthless. This event can significantly impact market volatility, liquidity, and sentiment as...

Deribit is a leading crypto options trading platform specializing in Bitcoin and Ethereum derivatives, offering advanced tools, low-latency execution, deep liquidity, and user-friendly features for both novice and professional traders. Its robust technology, portfolio margining system, real-time analytics, and 24/7...

Option trading profit percentage is a key indicator of return on investment, calculated by comparing the realized profit to the initial option premium while accounting for expenses like commissions and fees. Understanding options, calculating profits correctly, and considering factors such...

Option trading on expiry day involves heightened volatility and the potential for significant gains or losses as traders make final decisions regarding their positions. It's a critical time with specific rules, timelines, and phenomena like 'pinning' affecting market behavior; understanding...

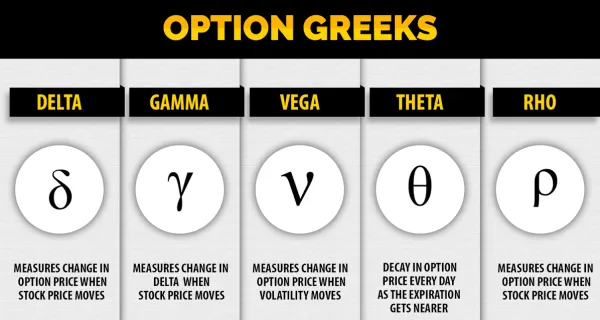

The Greeks are essential tools in the world of crypto options trading used to quantify risk and optimize returns. They measure different dimensions of risk, including sensitivity to the underlying price, acceleration of price changes, time decay, volatility, and interest...

Ethereum Options Expiry is a critical concept in cryptocurrency trading, referring to the date and time when Ethereum options contracts expire, impacting market volatility, price discovery, risk management, and liquidity. Understanding these expiries helps traders anticipate market movements and adjust...

This guide simplifies the process of using cryptocurrency for beginners, covering essential topics such as understanding what cryptocurrency is, choosing the right one, setting up a wallet, buying and managing assets, and ensuring security. By following this comprehensive roadmap, readers...

Understanding and adhering to minimum capital requirements is crucial for sustainable options trading, as it helps manage risks associated with leverage and market volatility. The amount needed varies depending on the broker and trading strategy, ranging from $500 for basic...

This article introduces chart analysis techniques for cryptocurrency trading. It covers the basics of reading candlestick charts, the pros and cons of different analysis techniques, and the importance of recognizing chart patterns and understanding moving averages. The article aims to...