Understanding Bear Market in Option Trading with Cryptocurrencies

When you start trading cryptocurrency options, you'll come across many terms. One such term you need to understand is "Bear Market". Not to be confused with the animal, a Bear Market in financial terms generally refers to a market condition wherein prices are falling or expected to fall.

The Significance of a Bear Market

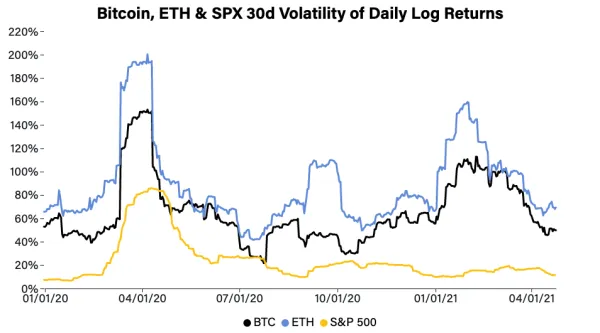

A Bear Market implies a prolonged period of falling prices that typically occurs in an economic downturn or recession. During such market conditions, pessimism rules. Traders have a negative outlook and believe prices will continue to drop. It can affect all types of investment assets, including stocks, real estate, and in our scenario, cryptocurrencies.

Bear Market and Cryptocurrency

In the world of cryptocurrency, a Bear Market represents a condition where the prices of cryptocurrencies like Bitcoin, Ethereum etc. are on a downward trend. For instance, when Bitcoin's price continuously falls for a couple of weeks or months, it can be inferred that Bitcoin is experiencing a Bear Market.

Bear Market in Cryptocurrency Options Trading

In the context of options trading, a Bear Market works a little differently. An options trader can use strategies to profit even in a Bear Market. Examples of such strategies are buying put options or selling call options. In both scenarios, the trader profits when the price of the underlying cryptocurrency falls.

How to Navigate a Bear Market

Experienced traders advise not to panic in a Bear Market scenario. The market is volatile, and prices will eventually bounce back up after hitting a certain low. Patience and a clear strategy, often involving the use of the above-explained options strategies, are what you need in a Bear Market.