Stablecoin

Stablecoin

Understanding Stablecoin in Crypto Options Trading

Stablecoin is a term frequently used in the world of cryptocurrency trading. It’s especially relevant when one is dealing with options trading in cryptocurrencies. A novice trader might wonder what Stablecoin is, and how it fits into the broader context of crypto options trading. Let's break it down.

What is a Stablecoin?

To put it simply, a Stablecoin is a type of cryptocurrency that is designed to maintain a stable value relative to a specific asset or pool of assets. This could be a currency like the US Dollar, or other assets like gold. The aim of Stablecoins is to reduce the typical volatility that can be experienced with other cryptocurrencies.

Stablecoin and Cryptocurrency Volatility

The Stablecoin aims to solve one of the major challenges in the crypto sphere: extreme volatility. Cryptocurrencies like Bitcoin and Ethereum often experience wide price fluctuations. But when it comes to crypto options trading, managing risk is crucial. Here is where Stablecoins become an important tool for traders.

How Does Stablecoin Work in Options Trading?

In crypto options trading, where you bet on the future price of a cryptocurrency, a Stablecoin can provide a risk-averse option. For instance, if you believe a particular cryptocurrency market will go sideways (neither up nor down in price), you could turn to a Stablecoin to limit your exposure to price volatility.

Stablecoin: An Effective Risk Management Strategy

Traders often use Stablecoins as part of a wider risk-management strategy in crypto options trading. Given their stability, Stablecoins can provide a level of security when the rest of the crypto market is turbulent. In conclusion, Stablecoins bring practicality, stability and increased safety to the world of crypto options trading.

Blog Posts with the term: Stablecoin

Crypto options contracts offer a new way for traders to hedge risk, diversify portfolios and speculate on price movements. These derivative trading instruments give the right but not obligation to buy or sell an underlying asset at a specific price...

Bitcoin options trading provides a strategic approach to cryptocurrency investment, allowing traders the right to buy or sell Bitcoin at a predetermined price before expiration without owning the actual asset. Understanding calls and puts is crucial for navigating market volatility...

Crypto options trading, an innovative form of investment that allows traders to buy or sell a cryptocurrency at a specified price and date, is gaining popularity in the US. The Commodity Futures Trading Commission (CFTC) regulates this type of trading;...

Crypto options trading is gaining traction in India, offering investors the flexibility to speculate on price movements without owning actual cryptocurrency. While crypto regulations remain ambiguous, there's no explicit ban on cryptocurrencies or derivatives like futures and options, making it...

This article serves as a beginner's guide to understanding options trading within the world of cryptocurrencies. It covers the basics of options trading, the types of crypto options, where to trade them, the pros and cons of crypto options trading,...

Deribit is a leading platform for Bitcoin options trading, offering deep liquidity, advanced analytics, and robust tools like the Option Wizard to cater to both novice and expert traders. Its focus on security, innovation, and user-friendly features makes it a...

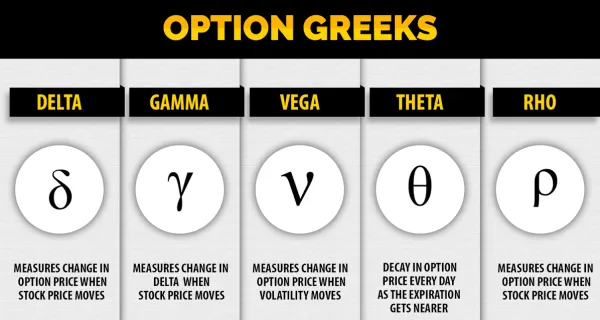

The Greeks are essential tools in the world of crypto options trading used to quantify risk and optimize returns. They measure different dimensions of risk, including sensitivity to the underlying price, acceleration of price changes, time decay, volatility, and interest...

This article provides an introduction to the options trading ecosystem in cryptocurrency. It explains the basic concepts, terminologies, and types of options, as well as how to choose the right trading platform. The article also offers a step-by-step guide on...

Crypto options are a type of financial derivative that allow traders to bet on future price movements of a cryptocurrency without actually owning it. This article provides a comprehensive introduction to crypto options, including their pros and cons, key terminology,...

Crypto options trading is a derivative strategy that allows traders to buy or sell cryptocurrencies at a predetermined price within a specific time frame. This article explains the basics of crypto options trading, its potential benefits and risks, and provides...

The article provides an introduction to crypto options trading, which involves buying or selling contracts that give the holder the right (but not obligation) to buy or sell a specific amount of cryptocurrency at a predetermined price within a set...

Crypto options trading, a less known but increasingly popular method in the finance world, allows traders to buy or sell cryptocurrencies at pre-determined prices within specified timeframes. Crypto options bots automate this process by executing trades based on set criteria...

Cryptocurrency is a decentralized digital or virtual form of currency that uses cryptography for security, with Bitcoin being the first and most prominent. The cryptocurrency market has seen significant growth since 2009, driven by factors such as blockchain technology, DeFi...

Decentralized finance (DeFi) is revolutionizing the finance world, with Ethereum leading the charge. Ethereum's unique features, such as its open and versatile blockchain platform, transaction speed, and security, make it the go-to platform for DeFi applications. The growing adoption of...