Rate of Change

Rate of Change

Understanding the Term: Rate of Change

The Rate of Change, or RoC, is used in technical analysis within the world of finance. Even in the landscape of option trading with cryptocurrencies, this term has a significant role. To put it simply, the Rate of Change is a financial concept that gauges the speed at which a price moves for an underlying asset, in this case, a cryptocurrency option. This is in relation to a given set period. This period could be days, weeks or months.

The Importance of Rate of Change in Option Trading

Rate of Change has a direct impact on option pricing. When you trade options in cryptocurrencies, a rapid price increase for a particular crypto asset could mean a rise in call options. Inversely, a swift decrease could mean a rise in put options. Therefore, understanding and being aware of the Rate of Change is vital for predicting market trends and making informed decisions in cryptocurrency option trading.

Calculating Rate of Change

The RoC is determined by substracting the price of the crypto asset today from the price as of 'x' periods ago. The outcome is then divided by the price from 'x' periods before, and the final result is expressed as a percentage. An increasing RoC is typically a sign of a bullish trend, while a decreasing RoC is seen as a bearish trend.

Using Rate of Change to Forecast Options

The Rate of Change serves as a way to predict market trends based on price momentum. Traders will frequently employ this method to figure out when they should enter or exit a trade. For instance, a sharp increase in the RoC can be a signal of an impending bullish trend, prompting the trader to invest in call options. Conversely, a steep decrease could indicate a bearish trend, suggesting the acquisition of put options.

Limitations of the Rate of Change

While the Rate of Change indicator offers a framework for assessing market momentum, it's not flawless. It assesses trends based on historical data which may not predict future performance. As an investor, it's essential to use the RoC in conjunction with other technical analysis tools for maximum effectiveness.

Blog Posts with the term: Rate of Change

Robinhood's platform allows users to trade options without commission fees, offering a way to speculate on stock prices, hedge risks, or earn income. However, it involves higher risk than traditional trading and requires approval based on one’s experience and knowledge;...

Option trading on Angel One offers a range of financial instruments, including call and put options, with features like American and European settlement styles; the platform provides resources for beginners. Traders can choose from various types of options such as...

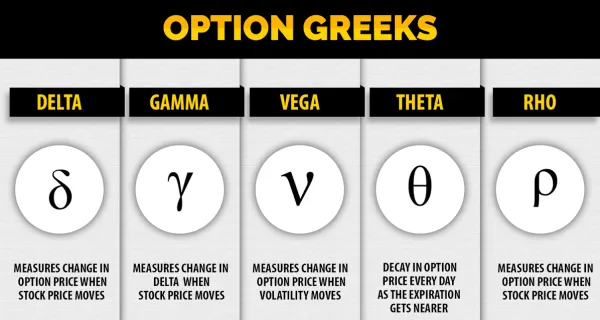

The Greeks are essential tools in the world of crypto options trading used to quantify risk and optimize returns. They measure different dimensions of risk, including sensitivity to the underlying price, acceleration of price changes, time decay, volatility, and interest...

Option trading is a versatile investment strategy that involves buying and selling options, which are contracts granting the right to buy or sell an asset at a set price within a specific period. The article covers fundamental concepts like call...

Option trading risk refers to the potential loss of capital due to unfavorable price movements in the options market, with factors such as type of option and volatility influencing this risk. Effective risk management is crucial for preserving trading capital...

Option trading involves contracts that give the buyer the right to buy or sell an asset at a set price before a certain date, without obligation. These flexible instruments cater to various strategies and require understanding of their mechanics for...

Fidelity offers a platform for trading Bitcoin options, which are financial derivatives allowing investors to buy or sell Bitcoin at a predetermined price before a specific date. This service includes robust security, comprehensive market data, and educational resources to aid...

Option trading data analysis is essential for understanding market sentiment and making informed decisions, involving metrics like price, volume, open interest (OI), and implied volatility. These indicators help traders identify entry and exit points in the market by signaling potential...

The article provides a beginner's guide to option trading in Hindi, explaining the basics of options as strategic investment tools that offer the right but not obligation to buy or sell assets at predetermined prices. It emphasizes the importance of...

Option trading data is essential for informed decisions, encompassing market indicators like asset prices, volume, and volatility. Understanding these metrics helps traders identify trends and assess risk in the volatile cryptocurrency options market. Data analysis in option trading guides strategy development...

The article explains the fundamentals and strategic advantages of trading Bitcoin options, highlighting their role in risk management, cost efficiency, speculative opportunities, and income generation through premiums. It also outlines a step-by-step guide for beginners to start trading Bitcoin options...

Understanding option trading fundamentals is key to maximizing returns, involving knowledge of calls and puts, various strategies for different market conditions, and factors affecting profitability. Risk management through techniques like stop-loss orders and diversification is crucial in sustaining long-term option...

Robinhood is democratizing Bitcoin options trading by offering a user-friendly interface, educational resources, low-cost trading, and real-time market data. This initiative aims to make advanced trading techniques accessible to everyone, including beginners with limited experience....

Bitcoin options trading offers investors the ability to manage risk or speculate on Bitcoin's future prices through contracts that allow buying or selling at predetermined prices within a set timeframe. Advanced analytics enhance strategic decision-making in this volatile market by...