Long Put

Long Put

Understanding the Long Put in Crypto Option Trading

If you're venturing into the dynamic world of option trading with cryptocurrencies, the term 'Long Put' is one you'll come across often. A Long Put is an essential term in option trading. It involves purchasing a put option with the expectation that the price of the underlying cryptocurrency will decrease. As a trader, you're 'long' on a put option when you buy it, hence the term 'Long Put'.

Breaking Down the Long Put

In the most basic sense, buying a put option gives you the right (but not the obligation) to sell a specific amount of an underlying asset (in this case, a cryptocurrency) at a predetermined price (the strike price) within a set time period (before the expiration date). If you believe that the price of a cryptocurrency, such as Bitcoin or Ether, will fall, you can buy a put option. If the price drops as expected, you make a profit.

Strategy of Long Put

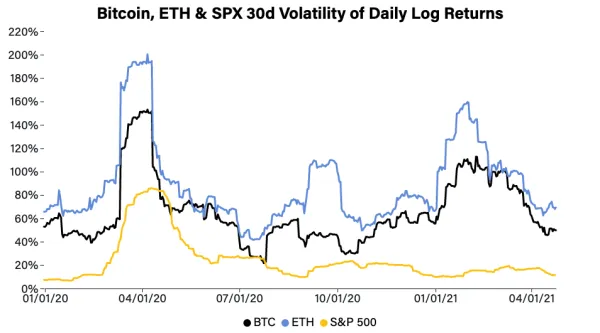

Long Put strategy allows traders to profit from a bearish market scenario. When the market is on a downward trend, and a cryptocurrency's price is expected to decrease, a Long Put can be an effective strategy. The more the price falls below the strike price, the more the Long Put's value increases, thereby yielding a higher payoff for the trader.

Risks and Rewards of a Long Put

While a Long Put can potentially lead to significant profits, it's essential to be aware of the risks. The premium paid for the put option could be lost completely if the market doesn't move in the anticipated direction before the option's expiration. However, the risk is limited to the price paid for the option.

Key Takeaways

A Long Put is a staple strategy in option trading with cryptocurrencies. It's used when a trader believes the price of a cryptocurrency will decrease. The profit potential is significant if the price drops below the strike price before the option expires. It's an intelligent way to get the most out of your investment during a bearish market. However, like all trading strategies, it carries risks, the biggest being the loss of the premium paid for the option.

Blog Posts with the term: Long Put

Crypto options trading allows speculation on future cryptocurrency prices without owning the asset, offering high returns with small investments but also significant risks. This guide covers essential concepts like call and put options, setting up a trading account, and basic...

Crypto options contracts offer a new way for traders to hedge risk, diversify portfolios and speculate on price movements. These derivative trading instruments give the right but not obligation to buy or sell an underlying asset at a specific price...

A Bitcoin options trading strategy helps traders manage risk and capitalize on market movements by using contracts that offer the right, but not obligation, to buy or sell at a set price. Utilizing tools like strategy builders allows for precise...

Crypto options trading, an innovative form of investment that allows traders to buy or sell a cryptocurrency at a specified price and date, is gaining popularity in the US. The Commodity Futures Trading Commission (CFTC) regulates this type of trading;...

Bitcoin options on the CME provide a regulated and secure platform for traders to hedge positions or speculate on Bitcoin's price movements without directly owning it, offering benefits such as risk management, leverage, flexibility, cash settlement, and high liquidity. This...

This article serves as a beginner's guide to understanding options trading within the world of cryptocurrencies. It covers the basics of options trading, the types of crypto options, where to trade them, the pros and cons of crypto options trading,...

Crypto options trading allows traders to profit from cryptocurrency volatility using strategies like covered calls, protective puts, and collars to manage risk and enhance returns. Understanding call and put options is essential for implementing these strategies effectively in the crypto...

Bitcoin options on futures are a new financial instrument in the cryptocurrency market that allow traders to speculate and hedge against future price fluctuations of Bitcoin. These contracts give holders the right, but not obligation, to buy or sell an...

Option trading with a small investment of $50-$100 is feasible, focusing on leveraging capital to control more stock and potentially increase profits while managing risks. Understanding call and put options, obtaining broker approval, and prioritizing education are key steps for...

Bitcoin option strategies are crucial for managing risks and optimizing returns in the volatile cryptocurrency market, offering flexibility through contracts that allow buying or selling Bitcoin at predetermined prices. Key strategies include Covered Call for income generation, Protective Put as...

YouTube is a popular video-sharing platform on the internet that offers a wide variety of videos for people to watch and enjoy, free of charge. It also provides tools for users to create and share quality content and a user-friendly...

Options trading has become popular in the financial world, especially with the rise of cryptocurrencies. Advanced techniques in crypto options trading, such as technical analysis, options spreads, hedging, straddles, and strangles, allow traders to maximize profits and mitigate risks, but...

Crypto options trading is a derivative strategy that allows traders to buy or sell cryptocurrencies at a predetermined price within a specific time frame. This article explains the basics of crypto options trading, its potential benefits and risks, and provides...

Option trading involves contracts that give buyers the right to buy or sell an asset at a set price before a certain date, with calls betting on price increases and puts on decreases. It requires strategic planning due to factors...

Crypto Over-the-Counter (OTC) options are a significant development in the cryptocurrency trading world, allowing investors to execute large-volume trades without significantly impacting market prices. These private deals between two parties can be customized and offer benefits such as liquidity, privacy,...