Long Call

Long Call

Understanding the Concept: What is a 'Long Call'?

A Long Call is a standard term in the world of option trading, including cryptocurrencies. As the name suggests, a Long Call option gives the buyer the right, but not the obligation, to purchase an underlying asset, in this case, a cryptocurrency, at a decided price within a specified period. This approach is generally employed when an investor predicts a substantial increase in the price of the cryptocurrency.

Delving Deeper: The Process of a Long Call

In a Long Call, the buyer needs to pay a premium, which goes to the seller of the Call Option. This premium is the maximum amount at risk for the option holder. The buyer is aiming to profit when the cryptocurrency price goes up significantly more than the premium paid. Ideally, a Long Call strategy is executed when the expectations for bullish market behaviour are high.

Investor Takeaway: Why Choose a Long Call?

A Long Call is an excellent strategy for investors looking to leverage their position, meaning it allows for potential high reward while limiting the risk to the invested amount. By purchasing a Long Call option, the buyer can control a higher number of cryptocurrencies with comparatively lower capital outlay. This advantage is of particular interest for investors who anticipate a price surge in the cryptocurrency market, but want to limit their exposure to risk.

Final Words: The Upside and the Risk of a Long Call

It's important to keep in mind that a Long Call plays out profitably when the market behaves as anticipated – in this case, a sharp rise in cryptocurrency price. On the other side, should the price drop, or not increase more than the premium paid, the investment is at the risk of becoming worthless. Any strategy involving options requires a good understanding of market trends, risks, and diligent management. Hence, it is recommended to gain relevant knowledge and possibly seek advice before getting started with options trading, including cryptocurrency options.

Blog Posts with the term: Long Call

Crypto options trading allows speculation on future cryptocurrency prices without owning the asset, offering high returns with small investments but also significant risks. This guide covers essential concepts like call and put options, setting up a trading account, and basic...

Crypto options contracts offer a new way for traders to hedge risk, diversify portfolios and speculate on price movements. These derivative trading instruments give the right but not obligation to buy or sell an underlying asset at a specific price...

A Bitcoin options trading strategy helps traders manage risk and capitalize on market movements by using contracts that offer the right, but not obligation, to buy or sell at a set price. Utilizing tools like strategy builders allows for precise...

Crypto options trading, an innovative form of investment that allows traders to buy or sell a cryptocurrency at a specified price and date, is gaining popularity in the US. The Commodity Futures Trading Commission (CFTC) regulates this type of trading;...

Bitcoin options on the CME provide a regulated and secure platform for traders to hedge positions or speculate on Bitcoin's price movements without directly owning it, offering benefits such as risk management, leverage, flexibility, cash settlement, and high liquidity. This...

This article serves as a beginner's guide to understanding options trading within the world of cryptocurrencies. It covers the basics of options trading, the types of crypto options, where to trade them, the pros and cons of crypto options trading,...

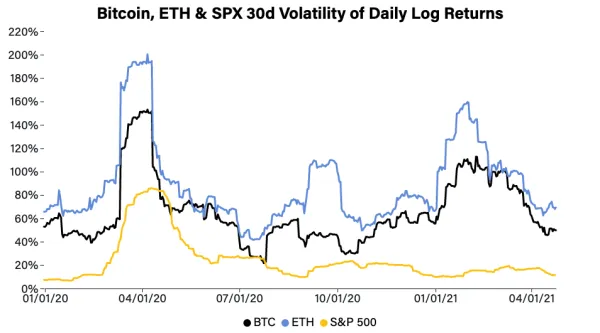

Crypto options trading allows traders to profit from cryptocurrency volatility using strategies like covered calls, protective puts, and collars to manage risk and enhance returns. Understanding call and put options is essential for implementing these strategies effectively in the crypto...

Bitcoin options on futures are a new financial instrument in the cryptocurrency market that allow traders to speculate and hedge against future price fluctuations of Bitcoin. These contracts give holders the right, but not obligation, to buy or sell an...

Option trading with a small investment of $50-$100 is feasible, focusing on leveraging capital to control more stock and potentially increase profits while managing risks. Understanding call and put options, obtaining broker approval, and prioritizing education are key steps for...

Crypto options trading on decentralized exchanges (DEXs) offers enhanced security, privacy, and lower fees by leveraging blockchain technology for peer-to-peer transactions. Popular platforms like Hegic, Opyn, and Premia provide diverse features catering to different trading needs while ensuring transparency and...

Bitcoin option strategies are crucial for managing risks and optimizing returns in the volatile cryptocurrency market, offering flexibility through contracts that allow buying or selling Bitcoin at predetermined prices. Key strategies include Covered Call for income generation, Protective Put as...

Option trading involves contracts that allow buying or selling an asset at a set price before expiration, with strategies for profit relying on predicting the asset's price movement and using leverage wisely. Option buyers use various strategies to maximize gains...

Option trading in Canada allows investors to buy and sell options contracts for various purposes, including income generation, hedging, or speculation. It's important for traders to understand the basics of option types, market positions, regulatory environment on exchanges like TSX...

Option trading losses occur when the premium paid exceeds returns from exercising or selling an option, influenced by market movement, time decay, and volatility. Understanding these losses is crucial for traders to employ strategies like hedging and stop-loss orders to...