Moving Average Convergence Divergence (MACD)

Moving Average Convergence Divergence (MACD)

What is Moving Average Convergence Divergence (MACD)?

The Moving Average Convergence Divergence (MACD) is an indicator used widely in technical analysis in the world of option trading with cryptocurrencies. By comparing the relationship between two moving averages of a crypto asset's price, the MACD can help traders identify potential buy and sell opportunities.

How does MACD work?

In simple terms, the MACD is a momentum indicator. It calculates the difference between a shorter term (such as 12 periods) exponential moving average (EMA) and a longer-term (like 26 periods) EMA. The result is the MACD line. A "signal line," which is typically the 9-period EMA of the MACD line, is then plotted on top of the MACD line, which can function as a trigger for buying or selling decisions.

MACD and Crypto Option Trading

In option trading with cryptocurrencies, MACD is seen as a valuable tool. This is because it is well-suited to track fast-paced changes and swings in price, common in the volatile crypto markets. When the MACD crosses above the signal line, it's considered a bullish (buy) signal. Conversely, when it crosses below the signal line, it's viewed as a bearish (sell) signal.

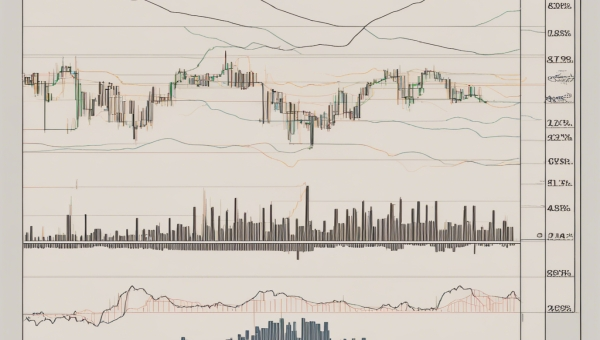

Reading the MACD Indicator chart

The MACD chart consists of three numbers that are used for its settings. The first is the number of periods for the faster-moving average. The second is the number of periods that are used in the slower moving average. And the third number is the number of bars to compare to plot the difference between the faster and the slower moving averages. When the MACD line moves above zero, it means the 12-period EMA is crossing above the 26-period. And when the MACD line moves under zero, the 12-period EMA is crossing below the 26-period EMA.

Final words on MACD

While the MACD indicator can be highly useful in identifying trend changes and potential buying or selling opportunities, it should not be used in isolation. Other aspects such as market news and other indicators should be considered as well for effective option trading with cryptocurrencies. The MACD can provide valuable information about the strength and direction of market momentum, but no single indicator can guarantee success in trading.

Blog Posts with the term: Moving Average Convergence Divergence (MACD)

Weekly expiry options, expiring every Friday, offer traders frequent opportunities to capitalize on short-term market movements with lower premiums and flexibility but come with challenges like rapid time decay and increased volatility. Effective strategies for trading these options include the...

This article provides an introduction to the Moving Average Convergence Divergence (MACD) indicator and its relevance in predicting price swings in cryptocurrencies. The MACD is a trend-following momentum indicator that can help traders determine when to buy or sell based...

The article explains the essential components and interpretation of crypto options trading charts, covering basics like time frames, price axes, candlesticks, volume bars, as well as advanced elements such as open interest, implied volatility (IV), strike prices, expiration dates, bid/ask...

Bitcoin Technical Analysis is a specialized field that uses historical trading data and indicators to predict the future price movements of Bitcoin. Understanding trends, volume, price levels, and market indicators can help traders make informed decisions in the volatile cryptocurrency...

Option trading stocks allow investors to potentially increase their investment returns through contracts that give the right, but not the obligation, to buy or sell at a specified price before a certain date. Understanding option types, pricing components like intrinsic...

Option trading involves financial derivatives allowing buyers to purchase or sell an asset at a set price before expiration, with strategies ranging from simple transactions to complex spreads. Indicators aid traders by providing data for strategy formulation and timing trades;...

Option trading is a flexible investment method with limited risk, involving contracts that grant the right to buy or sell an asset at a predetermined price by a certain date. Understanding options, including calls and puts, as well as pricing...

Option trading in the cryptocurrency market offers a way to diversify investment portfolios, with call and put options being fundamental instruments that allow traders to buy or sell at predetermined prices. Understanding key concepts such as strike price, expiration date,...

Technical analysis in options trading with cryptocurrencies involves analyzing historical price data and trading volumes to predict future movements, using tools like charts and indicators to identify patterns. Key concepts include support and resistance levels, moving averages, Bollinger Bands, RSI,...

Crypto stack options allow investors to speculate on cryptocurrency price movements without owning the assets, offering flexibility and risk management in a volatile market. Understanding key concepts like strike price, expiration date, premium, and diversification is essential for building a...

Bitcoin options paper trading is a risk-free, simulated environment for practicing and refining strategies in realistic market conditions, benefiting both beginners and experienced traders. It helps users master complex instruments, test strategies under volatility, build confidence, and develop consistency before...

Option trading offers flexibility and strategic opportunities in various market conditions, relying on understanding call and put options as foundational tools. Mastering option chains, key metrics like strike price, premium, open interest, and implied volatility is essential for informed decision-making...